Get Pr As 2745-a 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

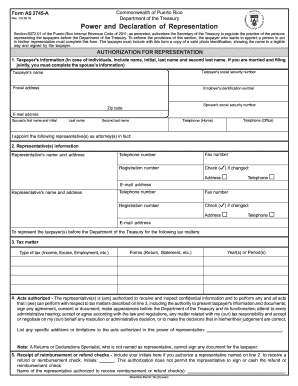

Tips on how to fill out, edit and sign PR AS 2745-A online

How to fill out and sign PR AS 2745-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can turn into a significant hurdle and a major hassle if proper assistance is not provided. US Legal Forms has been created as an online solution for PR AS 2745-A e-filing and offers numerous advantages for taxpayers.

Utilize the guidelines on how to complete the PR AS 2745-A:

Click the Done button in the upper menu when you have finished. Save, download or export the completed form. Utilize US Legal Forms to ensure secure and straightforward PR AS 2745-A completion.

- Obtain the blank from the website in the dedicated section or through the search feature.

- Click the orange button to access it and wait for it to load.

- Examine the template and adhere to the instructions. If you have never completed the form before, follow the step-by-step guidance.

- Pay attention to the highlighted fields. They are fillable and require specific information to be entered. If you are uncertain what information to provide, refer to the instructions.

- Always sign the PR AS 2745-A. Use the integrated tool to create the electronic signature.

- Select the date field to instantly insert the correct date.

- Review the template to verify and modify it before submission.

How to amend Get PR AS 2745-A 2016: personalize documents online

Equip yourself with the appropriate document management resources. Finalize Get PR AS 2745-A 2016 using our reliable tool that merges editing and eSignature capabilities.

If you wish to finalize and authenticate Get PR AS 2745-A 2016 online without any hassle, then our cloud-based solution is the perfect choice. We provide a comprehensive library of template-based documents that you can adjust and complete online.

Moreover, there is no need to print the document or rely on third-party services to make it fillable. All essential tools will be readily accessible once you access the document in the editor.

Let's explore our online editing tools and their primary functionalities. The editor features an easy-to-navigate interface, ensuring you can quickly learn how to utilize it.

We will review three key aspects that enable you to:

Obtain Get PR AS 2745-A 2016, implement the necessary modifications, and download it in your preferred file format. Give it a try today!

- Modify and annotate the document

- Rearrange your files

- Make them accessible for sharing

- Add security features

- Convert to different formats

- Enjoy a secure editing experience

Get form

When non-residents sell property in Puerto Rico, they face a withholding tax on the sale proceeds, typically at a rate of up to 15%. This tax is significant for non-residents, as it affects their financial returns and obligations. Knowing the specifics of this tax, especially in connection with PR AS 2745-A, is essential for informed decision-making.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.