Loading

Get Pr As 2645.1 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR AS 2645.1 online

This guide provides a clear and supportive approach to filling out the PR AS 2645.1 application for tax exemption online. It offers step-by-step instructions tailored for users, regardless of their familiarity with legal documentation.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to access the PR AS 2645.1 online application. This will allow you to fill out the form conveniently in the editor.

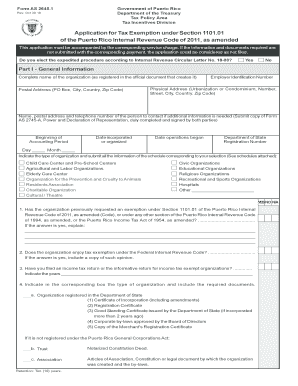

- Begin by entering the general information in Part I. This includes your organization’s complete name, postal and physical address, employer identification number, and the contact details for further inquiries. Be sure to provide accurate information as registered in official documents.

- Indicate your organization type and provide all required documentation based on the selected schedule (attached to the form). Ensure each document is correctly submitted alongside your application.

- Answer all yes/no questions regarding your organization's previous tax exemptions and compliance status. Provide detailed explanations where necessary, especially if submitting documentation regarding prior exemptions or current federal tax statuses.

- Continue filling out Part II, which focuses on your organization’s activities and operations. Follow the prompts to describe your past, current, and future activities in detail. Specify your sources of income and any fundraising initiatives.

- Complete the sections about the board of directors, administrative officers, and any relationships with other organizations. Include the required compensation details and documentation.

- Review all your entries and ensure that you have included any additional schedules or documentation required based on the nature of your organization.

- Finalize your application by saving any changes you made. You will have the option to download, print, or share the completed PR AS 2645.1 form as needed.

Don't wait, start filling out your PR AS 2645.1 online today and secure your tax exemption!

To establish residency in Puerto Rico for tax purposes, you must live there for at least 183 days each year. Additionally, individuals should demonstrate intent to reside in Puerto Rico by securing a local driver's license and registering to vote. Following these guidelines under PR AS 2645.1 may allow you to benefit from the island's tax advantages.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.