Loading

Get Pr 481.10 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 481.10 online

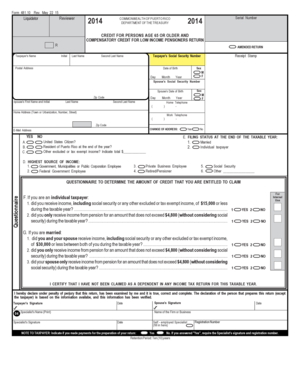

This guide provides a comprehensive overview of how to fill out the PR 481.10 form, typically used by individuals aged 65 or older and low-income pensioners in Puerto Rico. Follow these steps to complete the form accurately and efficiently.

Follow the steps to complete the PR 481.10 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your personal information at the top of the form, including your taxpayer's name, social security number, and date of birth. Additionally, include your spouse's information if applicable.

- Indicate your filing status by selecting whether you are married or an individual taxpayer. If you are married, ensure to provide your spouse's details.

- Complete the questionnaire section to determine eligibility for credits. Carefully answer questions related to income limits relevant to individual and married taxpayers.

- In the 'Highest Source of Income' section, select the appropriate options that reflect your and your spouse's sources of income.

- If applicable, fill in the 'Change of Address' section to update your address if it has changed since your last tax return.

- Review and confirm all entries to ensure they are correct and complete to avoid delays in processing.

- Finally, submit the form as required, ensuring it is signed by you and your spouse if filing jointly. You can save changes, download, print, or share the completed form as needed.

Complete your documents online to ensure a smooth filing process.

Related links form

Gaining experience with PR can be achieved through various means such as internships, volunteer work, or working for local businesses. Engaging with the community and networking can also enhance your understanding of Puerto Rican culture. Resources related to PR 481.10 can provide insights on getting involved and making the most of your experience in Puerto Rico.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.