Get Swrtb Final Earned Income And Net Profits Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

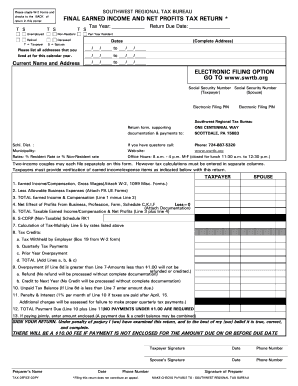

How to fill out the SWRTB Final Earned Income and Net Profits Tax Return online

Filling out the SWRTB Final Earned Income and Net Profits Tax Return online is a straightforward process. This guide provides step-by-step instructions to assist you throughout the form completion, ensuring you provide all necessary information accurately.

Follow the steps to successfully complete your tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your tax year and the return due date. Make sure these dates align with the relevant tax period.

- Indicate your current status by selecting one of the available options: unemployed, retired, non-resident, part-year resident, or deceased.

- Provide a complete address for the current name and any previous addresses where you resided during the calendar year. List all addresses in the specified sections.

- Enter the social security number for both the taxpayer and spouse in the designated fields.

- Complete the section regarding earned income by attaching necessary documents such as W-2 and 1099 Misc forms. Include gross wages and allowable business expenses.

- Calculate your total earned income and compensation by subtracting allowable business expenses from gross wages.

- Report any net profits from business, profession, or farm activities, ensuring to attach relevant documentation.

- Calculate your taxable earned income and net profits by aggregating previous totals.

- Determine the amount of tax due by multiplying the taxable income by the applicable tax rates provided.

- Input any tax credits, including tax withheld, quarterly payments, and any prior year overpayments.

- Assess if there's an overpayment or unpaid tax balance based on previous computations.

- Complete the section regarding penalties and interest that may apply if taxes are submitted late.

- Sign the return under penalty of perjury, confirming all information is accurate. Ensure both the taxpayer and spouse sign if filing jointly.

- After thoroughly reviewing all entries, save your changes, download the completed form, and prepare for submission.

Complete your SWRTB Final Earned Income and Net Profits Tax Return online today to ensure timely filing.

Reporting annuity income on your tax return involves declaring the total amount received over the year, which can generally be included in your taxable income. It's essential to check any tax exemptions that might apply and accurately report this income while filing your SWRTB Final Earned Income and Net Profits Tax Return. For detailed assistance, consider tools and resources available on uslegalforms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.