Get Ak Dor 225 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK DoR 225 online

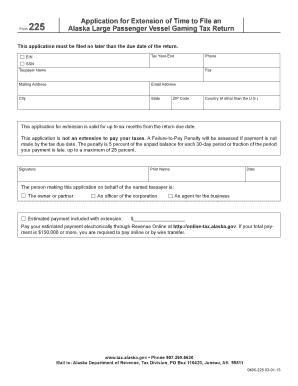

The AK DoR 225 form is a request for an extension of time to file the Alaska large passenger vessel gaming tax return. It is essential to complete this form accurately to ensure you secure the necessary extension without complications.

Follow the steps to fill out the AK DoR 225 form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter the tax year-end date in the designated field. This helps specify the fiscal period for which you are seeking an extension.

- Provide your employer identification number (EIN) in the appropriate section. This number is crucial for identifying your business tax obligations.

- Fill in your contact information, including phone number, mailing address, email address, city, state, ZIP code, and country if it differs from the United States.

- Indicate the taxpayer's name, ensuring to accurately represent the legal entity or individual requesting the extension.

- Select the role of the person submitting the application by checking the relevant box: owner or partner, officer of the corporation, or agent for the business.

- Input any estimated payment amount included with the extension request, if applicable. Ensure the amount reflects any anticipated tax liabilities.

- Sign and print your name in the appropriate fields, along with the date to validate the application.

- After ensuring all fields are correctly filled out, save your changes. You can then download, print, or share the completed form as needed.

Complete your AK DoR 225 application online today to ensure timely filing and avoid penalties.

Related links form

To file a K-1 on your taxes, begin by entering the information from your K-1 form on your tax return. Use the details provided to report any income, deductions, or credits included from this form. Incorporating information from AK DoR 225 can help you complete this process accurately. If needed, consider seeking assistance from tax preparation software or professionals to ensure you follow the correct procedures and avoid any potential errors.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.