Get Ar 2000-4 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR 2000-4 online

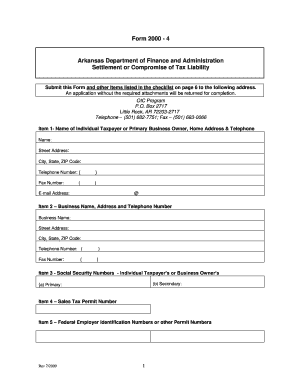

This guide provides users with a detailed overview of the AR 2000-4 form, designed for the settlement or compromise of tax liability. Follow the step-by-step instructions to ensure accurate completion and submission of the form online.

Follow the steps to complete the AR 2000-4 form effectively

- Click the ‘Get Form’ button to retrieve the AR 2000-4 and open it in the editor.

- In Item 1, enter the name of the individual taxpayer or primary business owner along with their home address and telephone details.

- Proceed to Item 2, where you will input the business name, address, and relevant telephone number.

- In Item 3, provide the social security numbers for the individual taxpayer or business owner, including primary and secondary numbers.

- Item 4 requires you to enter the sales tax permit number. If unknown, assistance can be sought by contacting the provided help number.

- Complete Item 5 with the federal employer identification number or other relevant permit numbers.

- In Item 6, specify the tax types and the related periods for which you are submitting this compromise offer by marking the corresponding boxes.

- Item 7 pertains to bankruptcy history. List all prior bankruptcies or indicate 'NA' if none apply.

- In Item 8, explain why a payment plan is not a viable option for settling the liability.

- For Item 9, check the appropriate reasons that justify your offer, providing detailed explanations as needed.

- In Item 10, write the amount you are offering to pay, ensuring it is not zero. Specify the source of this payment.

- Complete the explanation of circumstances section, detailing why the department should consider your offer.

- Ensure necessary signatures are obtained from the taxpayer, spouse (if applicable), and any authorized representatives.

- Finally, save changes, download, print, or share the completed form as required before submitting it along with all required attachments.

Take action today by completing the AR 2000-4 online to address your tax liabilities.

Get form

To file exempt on your W-4, you need to meet specific criteria and certify that you owe no federal income tax for the previous year and expect to owe none for the current year. On the W-4 form, write 'Exempt' in the space provided to indicate your status. Make sure to keep records that support your exempt status, as the IRS may request these. Using USLegalForms can provide you with the correct forms and instructions to ensure you file exempt properly using the AR 2000-4.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.