Loading

Get Ky 51a158 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 51A158 online

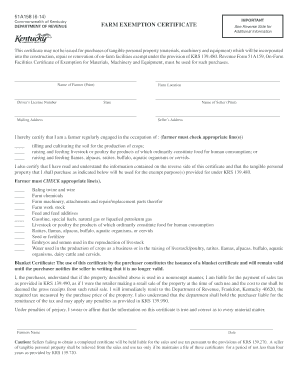

The KY 51A158 is a farm exemption certificate used for certain tax-exempt purchases in Kentucky. This guide provides a comprehensive overview and step-by-step instructions on how to fill out this form online, ensuring you meet all requirements for a smooth application process.

Follow the steps to fill out the KY 51A158 online effectively

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Begin by filling in the name of the farmer at the top of the form. Ensure that the name is printed clearly.

- Next, provide the farm location by filling in the relevant address details to specify where the farm is situated.

- Enter the driver's license number and the state in which the license was issued. This verification is vital for identification purposes.

- Complete the mailing address section with the farmer’s current address, which will be used for any correspondence.

- Fill in the name of the seller and their address. This information is necessary to establish the transaction details.

- Certify your farming activities by checking the appropriate boxes that describe your occupation. You can select more than one option related to farming practices.

- Then, check all applicable lines to indicate the tangible personal property you intend to purchase tax-exempt. This section outlines various items such as farm machinery, feeds, and seeds.

- Acknowledge the blanket certificate by expressing your understanding of its validity until you provide written notice of cancellation.

- Sign and print your name in the designated area and include the date of signing at the bottom of the form.

- Finally, review all entered information for accuracy. You may now save the changes, download, print, or share the completed form as needed.

Complete your KY 51A158 form online today to ensure your farming purchases remain tax-exempt.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In New Jersey, various entities and individuals are exempt from sales tax. Common exemptions include non-profit organizations, certain governmental units, and specific agricultural purchases. To ensure you qualify and to easily navigate through the application process, refer to guidelines or consult relevant forms, like the KY 51A158 where applicable.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.