Get Ca Ftb 541 - Schedule K-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 541 - Schedule K-1 online

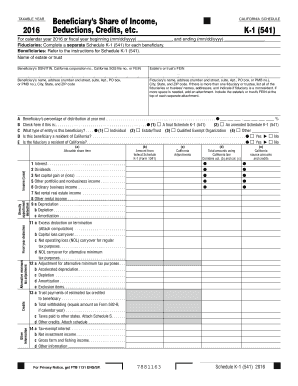

The CA FTB 541 - Schedule K-1 is an important tax document used to report a beneficiary's share of income, deductions, and credits from an estate or trust. Filling out this form correctly is essential for both fiduciaries and beneficiaries in meeting their tax obligations.

Follow the steps to complete the CA FTB 541 - Schedule K-1 online.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred document editor.

- Begin by entering the taxable year at the top of the form. Specify whether it is for a calendar year or a fiscal year by entering the starting and ending dates in the designated formats.

- Provide the name of the estate or trust in the specified field.

- Input the beneficiary’s Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), California corporation number, California Secretary of State (SOS) file number, or Federal Employer Identification Number (FEIN) as appropriate.

- Include the estate's or trust's FEIN in the indicated section.

- Fill in the beneficiary’s details, including name, address (number and street, suite, apt, PO box, or PMB number), city, state, and ZIP code.

- List the fiduciary’s name and address, ensuring to include details for all fiduciaries or trustees involved. If there are multiple fiduciaries, provide their information separately or in an attached document.

- Indicate the beneficiary's percentage of distribution at year-end as a percentage in the designated field. Ensure to check the appropriate box if this is a final or amended Schedule K-1.

- Select the type of entity for the beneficiary from the provided options: individual, estate/trust, qualified exempt organization, or other.

- State whether the beneficiary and the fiduciary are residents of California by checking 'Yes' or 'No' in the respective sections.

- Complete the allocation section by listing the allocable share items in the appropriate columns: amount from federal Schedule K-1, California adjustments, total amounts using California law, California source amounts and credits.

- Fill in the details for various types of income such as interest, dividends, capital gains/losses, business income, and any deductions or credits explicitly mentioned.

- Review the entire form for completeness and accuracy, ensuring all sections are filled out according to the guidelines.

- Once filled out, save your changes, download the document, or print it for your records. Share it with relevant parties as needed.

Begin completing your CA FTB 541 - Schedule K-1 online today to ensure you meet your tax obligations accurately.

Get form

Related links form

A Schedule K-1 for inheritance tax typically refers to information regarding inherited assets that may have tax implications. While inheritances aren’t directly reported on K-1, if you're receiving distributions from an estate or trust, you may encounter a K-1 related to that income. Understanding how to navigate these situations using the CA FTB 541 - Schedule K-1 can help you manage tax liabilities effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.