Get Ri Tx-17 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign RI TX-17 online

How to fill out and sign RI TX-17 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The era of daunting intricate legal and tax paperwork has ended. With US Legal Forms, the complete procedure of completing official forms is stress-free. The premier editor is right at your disposal, offering you an extensive array of practical tools for filling out a RI TX-17. The subsequent suggestions, along with the editor, will support you throughout the entire procedure.

We simplify the process of completing any RI TX-17. Utilize it now!

- Press the Get Form button to start filling out.

- Activate the Wizard mode in the upper toolbar to gain additional guidance.

- Complete each editable section.

- Verify that the information you input into the RI TX-17 is current and precise.

- Specify the date on the template using the Date function.

- Click the Sign button to create a digital signature. You can choose from 3 options: typing, drawing, or capturing one.

- Thoroughly review each field to ensure it has been completed correctly.

- Select Done in the top right corner to save or dispatch the document. There are various ways to receive the document, such as an email attachment, via postal mail as a hard copy, or as an instant download.

How to Modify Get RI TX-17 2020: Personalize Forms Online

Streamline your document preparation approach and tailor it to your needs within moments. Fill out and endorse Get RI TX-17 2020 using a robust yet intuitive online editor.

Document preparation is frequently tedious, especially when you handle it sporadically. It requires strict adherence to all protocols and precise completion of every field with detailed information. However, it often happens that you need to amend the form or add additional fields for completion. If you need to enhance Get RI TX-17 2020 before submission, the optimal solution is through our powerful yet user-friendly online editing tools.

This comprehensive PDF editing tool permits you to swiftly and effortlessly complete legal documents from any connected device, make simple modifications to the form, and introduce additional fillable fields. The platform lets you designate a specific area for each type of information, such as Name, Signature, Currency, and SSN, among others. You can make them mandatory or conditional and designate who should fill out each section by assigning them to specific recipients.

Follow the steps below to enhance your Get RI TX-17 2020 online:

Our editor is a versatile multi-functional online solution that can assist you in efficiently and effectively enhancing Get RI TX-17 2020 and other templates to fit your needs. Improve document preparation and submission time and ensure your documentation appears flawless without difficulty.

- Access the necessary template from the directory.

- Complete the empty spaces with Text and use Check and Cross tools on the checkboxes.

- Use the toolbar on the right side to alter the form with additional fillable sections.

- Select the fields based on the type of information you wish to gather.

- Designate these fields as required, optional, or conditional and arrange their sequence.

- Allocate each field to a specific participant using the Add Signer feature.

- Verify that you’ve made all necessary adjustments and click Done.

Get form

Related links form

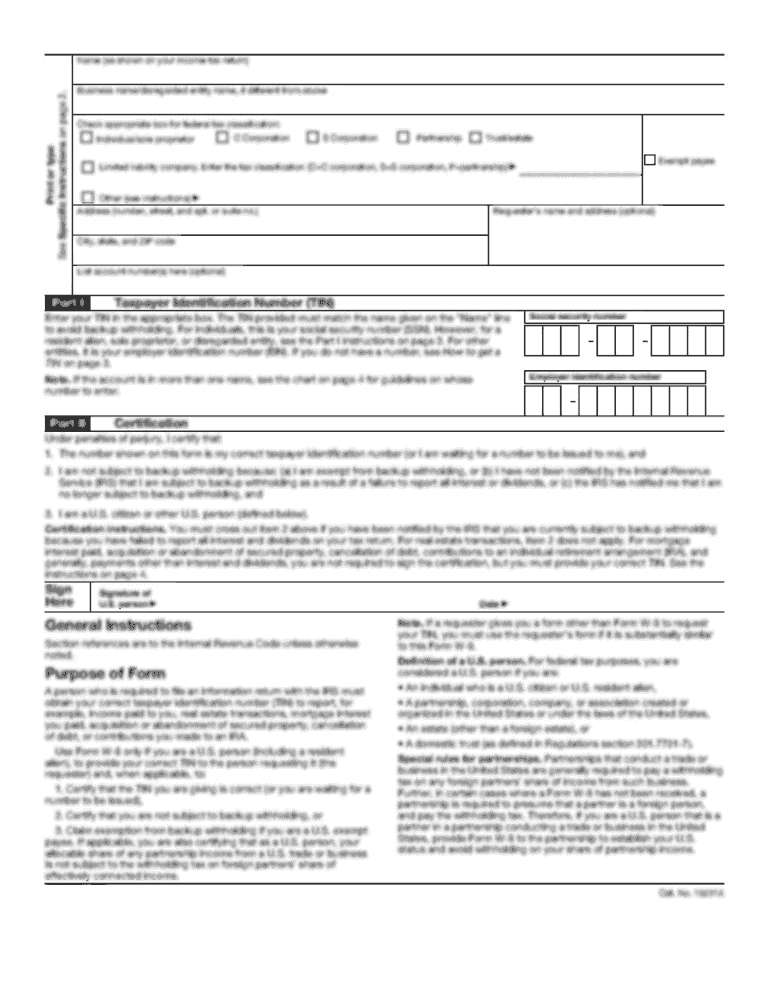

RI TX-17 is a specific form associated with reporting and managing state taxes in Rhode Island, particularly concerning employer tax responsibilities. It typically involves the reporting of payroll taxes, including withholdings and unemployment contributions. Utilizing USLegalForms can streamline the completion of RI TX-17, ensuring you’re meeting all necessary obligations efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.