Loading

Get Irs 720 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 720 online

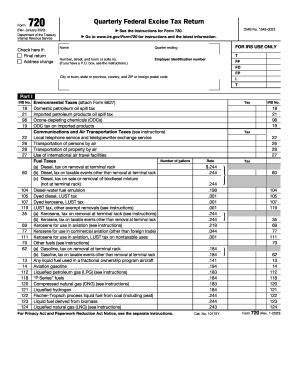

This guide aims to provide a clear and comprehensive overview of the IRS 720 form, which is essential for reporting quarterly federal excise taxes. It will walk you through each section and field of the form to ensure accurate completion and submission.

Follow the steps to effectively complete the IRS 720 online

- Press the ‘Get Form’ button to access the IRS 720 form and open it in the online editor.

- Fill in your name and address in the designated fields at the top of the form. Ensure that your Employer Identification Number (EIN) is correctly entered.

- Select the quarter ending by marking the appropriate box on the form. This is important for timely reporting.

- In Part I, input any applicable environmental taxes and excise taxes. Carefully enter the required figures for fuel taxes and the number of gallons related to each type.

- Proceed to Part II and enter the Patient-Centered Outcomes Research Fee if applicable. Ensure you provide the details related to the average number of lives covered.

- Add the totals from Part I and Part II in Part III. This will give you the total tax due. Make sure each calculation is accurate to avoid any discrepancies.

- If applicable, complete any claims in Schedule C. Ensure to follow instructions for claims related to any nontaxable use of fuel.

- Review all information for accuracy and completeness. After confirming that all sections are properly filled out, save your changes.

- Download, print, or share the completed form as needed. If you're submitting payment, complete Form 720-V and include it with your payment.

Start filling out your IRS 720 form online today to ensure timely compliance with federal excise tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To avoid federal excise tax, ensure your health insurance offerings comply with federal regulations. Regularly reviewing your coverage and adjusting it to meet IRS standards is a proactive approach. Additionally, using tools and resources from UsLegalForms can guide you through compliance strategies to minimize your tax liabilities effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.