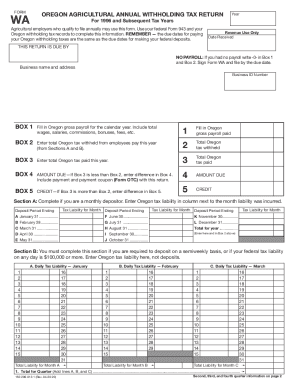

Get Or Dor Wa 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OR DoR WA online

How to modify Get OR DoR WA 2020: personalize documents online

Sign and distribute Get OR DoR WA 2020 along with any additional business or personal paperwork online, eliminating the need for printing and mailing, thus saving time and resources. Maximize the utility of our online document editor equipped with a built-in compliant eSignature feature.

Signing and submitting Get OR DoR WA 2020 forms electronically is quicker and more effective than handling them on paper. Nonetheless, it necessitates the utilization of online tools that guarantee a high level of data protection and provide a certified solution for generating electronic signatures. Our comprehensive online editor is just what you need to accurately and appropriately fill out your Get OR DoR WA 2020 as well as other personal, business, or tax forms according to all specifications. It comprises all essential tools for efficiently filling out, modifying, and signing documents online, as well as adding Signature fields for others, indicating who should sign and where.

It takes merely a few straightforward steps to complete and endorse Get OR DoR WA 2020 online:

When endorsing Get OR DoR WA 2020 with our robust online solution, you can always trust it to be legally binding and admissible in court. Prepare and submit documents in the most advantageous way possible!

- Open the chosen document for further editing.

- Utilize the top toolset to insert Text, Initials, Image, Check, and Cross marks into your template.

- Highlight the most important details and blackout or remove sensitive information if necessary.

- Click on the Sign tool above and select your preferred method to eSign your form.

- Sketch your signature, type it out, upload an image of it, or choose another suitable option.

- Proceed to the Edit Fillable Fields section and drop Signature areas for others.

- Hit Add Signer and enter your recipient’s email to designate this field to them.

- Ensure that all information provided is complete and accurate before you click Done.

- Share your document with others using one of the available methods.

No, Washington's Business and Occupation (B&O) tax is not the same as the excise tax, although both are types of taxes applicable in the state. The B&O tax is based on gross receipts from business activities, while the excise tax is primarily levied on the sale of specific goods and services. Understanding these differences is key, and US Legal Forms can provide detailed insights to clarify your obligations regarding these taxes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.