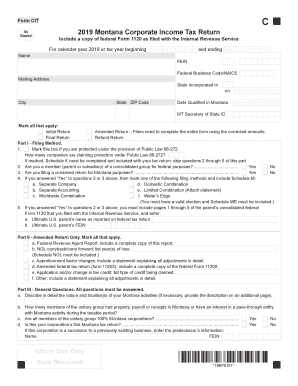

Get Mt Cit (clt-4) 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MT CIT (CLT-4) online

How to modify Get MT CIT (CLT-4) 2019: personalize forms online

Utilize our all-encompassing online document editor effectively while filling out your forms. Complete the Get MT CIT (CLT-4) 2019, highlight the most significant details, and easily make any other necessary adjustments to its content.

Filling out documents digitally not only saves time but also allows for alterations to the template based on your requirements. If you plan to work on Get MT CIT (CLT-4) 2019, think about finishing it with our wide-ranging online editing tools. Whether you accidentally made a typo or input data in the incorrect section, you can swiftly modify the form without needing to restart from scratch as you would during manual completion.

Additionally, you can emphasize critical information in your document by highlighting specific content with colors, underlining them, or encircling them.

Our robust online solutions represent the most efficient method to complete and alter Get MT CIT (CLT-4) 2019 based on your specifications. Utilize it to handle personal or professional documents from anywhere. Access it in a browser, make necessary alterations in your forms, and revisit them at any time in the future - they will all be securely stored in the cloud.

- Access the form in the editor.

- Input the required information in the blank sections using Text, Check, and Cross tools.

- Follow the form navigation to ensure you don’t overlook any vital areas in the template.

- Encircle some of the significant details and include a URL if necessary.

- Utilize Highlight or Line tools to emphasize the most crucial pieces of content.

- Select colors and thickness for these lines to give your document a professional appearance.

- Delete or obscure the information you prefer not to be visible to others.

- Replace content that has errors and input the text you require.

- Conclude editing by clicking the Done button once you confirm everything is correct in the form.

Get form

An automatic state extension means you can extend your filing deadline without having to provide a reason. For the MT CIT (CLT-4), this allows additional time for you to prepare and submit your corporate tax returns. However, remember that this does not extend the deadline for any tax payments owed. Using US Legal Forms, you can easily navigate these requirements and ensure compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.