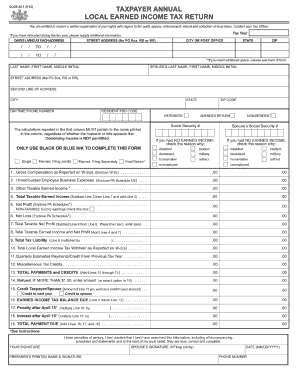

Get Pa Dced Clgs-32-1 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PA DCED CLGS-32-1 online

How to fill out and sign PA DCED CLGS-32-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax blanks can escalate into a major issue and considerable hassle if inadequate support is offered.

US Legal Forms has been developed as a digital solution for PA DCED CLGS-32-1 online filing and offers numerous benefits for taxpayers.

Click the Done button in the top menu once you have finished. Save, download, or export the completed template. Use US Legal Forms to ensure an easy and convenient completion of the PA DCED CLGS-32-1.

- Obtain the blank form online in the appropriate section or through the search engine.

- Press the orange button to access it and wait for it to load.

- Examine the template and heed the instructions. If you are unfamiliar with the form, adhere to the step-by-step guidance.

- Pay attention to the highlighted fields. They are fillable and require specific information to be provided. If you are unsure about what to input, review the instructions.

- Always sign the PA DCED CLGS-32-1. Use the built-in feature to create your electronic signature.

- Click on the date field to automatically enter the correct date.

- Revisit the template to verify and make changes before submitting it electronically.

How to modify Get PA DCED CLGS-32-1 2012: personalize forms online

Choose a dependable document editing solution you can rely on. Revise, complete, and authenticate Get PA DCED CLGS-32-1 2012 securely online.

Frequently, altering documents, such as Get PA DCED CLGS-32-1 2012, can be troublesome, particularly if you obtained them online or through email but lack access to specialized tools. While you might find some alternatives to navigate the issue, you risk producing a form that won’t meet submission standards. Using a printer and scanner isn’t ideal either as it's labor- and resource-intensive.

We offer a more seamless and efficient method for adjusting forms. A comprehensive selection of document templates that are simple to edit and certify, and can be made fillable for others. Our platform extends well beyond just a collection of templates. One of the greatest advantages of choosing our option is the ability to modify Get PA DCED CLGS-32-1 2012 directly on our site.

Being a web-based service, it frees you from needing to acquire any software. Additionally, not every corporate policy permits you to install it on your work laptop. Here’s the optimal way to effortlessly and securely finalize your documents with our solution.

Put aside paper and other ineffective methods for completing your Get PA DCED CLGS-32-1 2012 or other documents. Employ our tool instead that amalgamates one of the most extensive libraries of ready-to-customize forms with a robust document editing feature. It's straightforward and secure, and can save you a considerable amount of time! Don’t just take our word for it, give it a try yourself!

- Click the Get Form > you’ll be promptly directed to our editor.

- Once opened, you can commence the customization process.

- Choose checkmark or circle, line, arrow, and cross along with other choices to annotate your document.

- Select the date field to include a specific date in your template.

- Incorporate text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to generate fillable {fields.

- Select Sign from the top toolbar to create and establish your legally-binding signature.

- Click DONE and save, print, share or obtain the final {file.

Get form

Certain types of income may be exempt from local earned income tax in Pennsylvania, including Social Security benefits, pensions, and unemployment compensation. Each municipality may have different exemptions, so it is essential to review the applicable local laws and the PA DCED CLGS-32-1 guidelines to understand your situation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.