Loading

Get Irs Notice 1036 2019-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Notice 1036 online

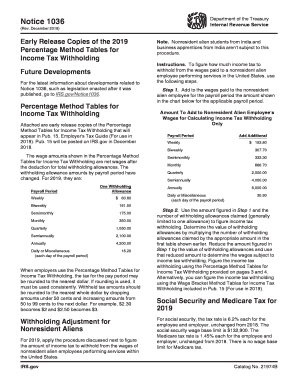

Filling out the IRS Notice 1036 online can be a straightforward process with the right guidance. This document provides early release copies of the Percentage Method Tables for Income Tax Withholding, which are essential for employers and payroll processors.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the introductory section of the form which contains important information about the purpose of the Notice 1036 and links to related developments.

- Locate the Percentage Method Tables provided for various payroll periods. Ensure you understand the wage amounts shown after allowances as these will affect withholding calculations.

- Fill in the required information, including the payroll period type (weekly, biweekly, etc.) and the applicable withholding allowances based on wage amounts.

- For nonresident aliens, follow the special instructions by adding additional amounts to wages as specified in the guidelines.

- Calculate the income tax withholding using either the Percentage Method or Wage Bracket Method Tables provided in the document.

- Review the instructions related to Social Security and Medicare taxes to ensure compliance with rates and wage base limits.

- Once all sections are filled accurately, save changes, download, or print the form as needed to complete your filing duties.

Complete your filings online by following the steps outlined above.

Yes, you can view IRS notices online through your IRS Online Account. This feature allows you to access your tax information, including any notices sent by the IRS. It is a convenient way to stay informed and act promptly on important communications. Understanding the significance of IRS Notice 1036 can add further clarity to your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.