Get Or W2 File Specifications 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR W2 File Specifications online

Filing the OR W-2 File Specifications is essential for employers and payroll service providers in Oregon to comply with state tax reporting regulations. This guide provides a clear and systematic approach to filling out the specifications online, ensuring you meet all necessary requirements.

Follow the steps to complete the OR W2 File Specifications accurately.

- Press the ‘Get Form’ button to access the OR W-2 File Specifications and open the form in your preferred editing interface.

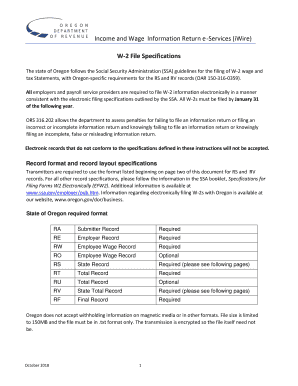

- Begin by entering the RA record, which includes your submitter information. Ensure all fields are completed accurately as required.

- Fill out the RE record. This contains employer-specific information, including the identification and details that must match your legal documentation.

- Input the RW record, which captures the employee wage information. Make sure all amounts are formatted as specified: no punctuation, right-justified, and zero-filled if necessary.

- Complete optional fields with the RO record if applicable. This contains additional employee wage data that may enhance reporting accuracy but is not mandatory.

- Provide the RS record to report state-specific details, particularly for employees working in Oregon. Include taxable wages for the statewide transit tax where applicable.

- Fill in the RT record, summarizing the total wages. Ensure this is aligned accurately with previous records submitted.

- Complete the RV record to summarize total taxable wages and taxes withheld, especially for the statewide transit tax, ensuring consistency across all records.

- Finalize the RF record to signify the end of the data submission. Confirm all entries are accurate and complete before proceeding.

- Review the entire document for accuracy and completeness. You may then save your changes, download the file, print it, or share it as required.

Ensure your reporting is compliant—complete your OR W2 File Specifications online today.

Get form

Related links form

The minimum requirement for W-2 forms includes reporting wages, tips, and other compensation for employees. According to OR W2 File Specifications, employers must accurately report both employee and employer identification details as well as federal and state tax withholdings. It’s crucial to ensure compliance with these minimum requirements to avoid potential penalties, and platforms like uslegalforms can assist in maintaining this compliance effortlessly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.