Loading

Get Or W2 File Specifications 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR W2 File Specifications online

Filing the OR W2 file specifications is an important step for employers in Oregon to ensure compliance with state and federal requirements. This guide aims to provide clear instructions on how to accurately complete each section of the specifications online.

Follow the steps to successfully complete the OR W2 File Specifications.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

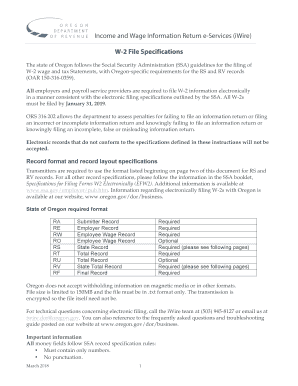

- Review the specifications for the RS and RV records thoroughly to understand the required fields. Make sure to follow the record format and layout specifications for accurate submission.

- Begin filling out the Employee Wage Record (RS). Start with the Record Identifier, which must be two characters long, followed by the State Code, which should also be two characters.

- Continue entering the Employee's Social Security Number, first name, middle name or initial, last name, and any applicable suffixes where necessary. Ensure each field adheres to the specified character limits.

- Input the location address, delivery address, city, state abbreviation, ZIP code, and ZIP code extension. Ensure that all information is left-justified and correctly formatted.

- Fill in the fields for taxable wages and the amounts withheld for state income tax and the statewide transit tax. Follow the required number formatting — right-justify and zero-fill to the left.

- After completing the RS record, proceed to the RV record. Start by indicating the Record Identifier and the Number of RS Records. Provide total amounts for state taxable wages and state withholding.

- Review all entered data for accuracy and completeness, ensuring that no fields are left blank unless specifically required.

- Once satisfied with the form, save changes, and you can choose to download, print, or share the filled-out specifications as needed.

Start completing the OR W2 file specifications online to ensure compliance with Oregon's filing requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

2 forms should be printed in a legible font that complies with IRS guidelines. A common choice is Sans Serif font, which ensures readability and clarity. It is essential to follow the OR 2 File Specifications to avoid potential rejections due to formatting issues. If you need assistance, the USLegalForms platform provides valuable resources to help you format your 2 correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.