Loading

Get Ma Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ma Form online

Filling out the Ma Form online is a straightforward process that can help you efficiently manage your tax obligations. This guide provides step-by-step instructions to aid users of all experience levels in completing the form with clarity and confidence.

Follow the steps to successfully complete the Ma Form online.

- Click ‘Get Form’ button to obtain the document and open it in your preferred editor.

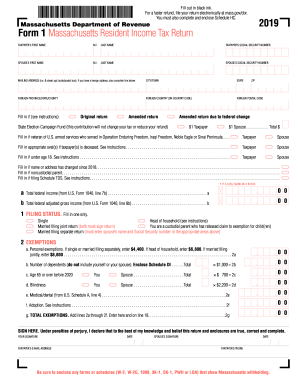

- Begin by entering the taxpayer’s first name, middle initial, and last name. Ensure you input the correct Social Security number, which is crucial for identification purposes.

- For the spouse’s information, input their first name, middle initial, last name, and Social Security number, if applicable.

- Fill in your mailing address, including the number and street, apartment or suite number, and postal box. If your address is foreign, complete the additional fields for the city/town, state, ZIP code, province/state/county, and postal code.

- Indicate whether this is an original return, amended return, or an amended return due to federal change by filling in the appropriate oval.

- Contribute to the State Election Campaign Fund if you wish, by marking the respective ovals for taxpayer and spouse.

- Complete the sections related to military service, deceased individuals, and dependents, as applicable. Make sure to include the necessary details for each category.

- Enter earnings from wages, pensions, business income, and other sources as specified in the income section. Ensure accuracy by referencing your W-2 or other income sources.

- Proceed to the deductions section. Enter totals for Social Security and Medicare payments, childcare expenses, and any eligible deductions based on your circumstances.

- Calculate your total tax liability using the applicable rates based on the total taxable income and any credits you qualify for.

- Finally, review the completed form for accuracy, then save your changes. You may download, print, or share the form as needed.

Complete your documents online today for efficiency and ease.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When filing your Massachusetts tax return, ensure you include the completed MA Form, any relevant schedules, and supporting documents such as W-2s. Additionally, if you are claiming credits or deductions, include the necessary documentation as proof. Staying organized and thorough will help expedite the processing of your return and reduce potential delays.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.