Loading

Get Or Or-stt-2 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR OR-STT-2 online

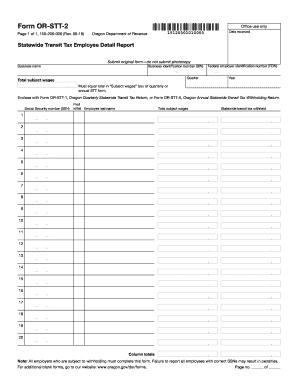

Filling out the OR OR-STT-2 form is essential for employers to report and remit the statewide transit tax for their employees. This guide provides clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the OR OR-STT-2 form accurately.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the business name in the designated field to identify the entity submitting the report.

- Input the Business Identification Number (BIN) in the corresponding section, which is required for tracking purposes.

- Provide the Federal Employer Identification Number (FEIN) to comply with federal regulations.

- Indicate the total subject wages paid to employees during the reporting period in the dedicated field.

- Specify the quarter and year for which the report is being submitted, ensuring accuracy in reporting the timeframe.

- List each employee's Social Security Number (SSN) accurately to avoid penalties due to incorrect reporting.

- Record the first initial and last name of each employee as requested to maintain identification integrity.

- For each employee listed, enter the total subject wages paid during the reporting period in the appropriate column.

- Document the total amount of statewide transit tax withheld from each employee's wages.

- Add up the columns to provide the column totals for total subject wages and total statewide transit tax withheld.

- If using additional pages, ensure that the total amounts are reflected only on page 1.

- Prepare to submit the completed OR-STT-2 form along with Form OR-STT-1 or Form OR-STT-A, including payment when applicable.

- Once the form is completed, you can save your changes, download, print, or share the document as needed.

Complete and file your OR OR-STT-2 form online today to ensure compliance with Oregon's transit tax regulations.

Related links form

The STT tax, or Statewide Transit Tax, is a percentage deducted from your income to fund public transit in Oregon. It is reflected as OR OR-STT-2 on your paychecks and helps support vital transit services. Familiarizing yourself with this tax can help you understand its impact on your finances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.