Get Or Form Or-tm 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Form OR-TM online

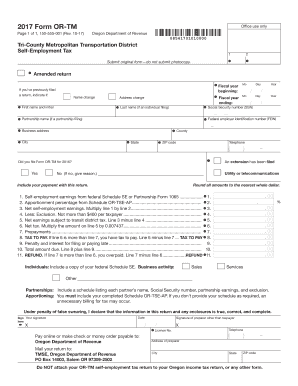

Filling out the OR Form OR-TM online can be an efficient way to manage your self-employment tax obligations within the Tri-County Metropolitan Transportation District. This guide provides clear, step-by-step instructions to help users navigate the form and its components.

Follow the steps to successfully complete the OR Form OR-TM online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Enter your personal information in the name and address section. For individuals, include your first name, middle initial, last name, social security number, business address, county, city, state, and ZIP code.

- Indicate any changes such as name or address changes if applicable.

- Provide your fiscal year information including the beginning and ending months and years.

- Fill in your federal employer identification number (FEIN) if applicable.

- Select 'Yes' or 'No' regarding whether you filed Form OR-TM for the previous year. If applicable, indicate if an extension has been filed.

- Complete the self-employment earnings section by entering the amount from your federal Schedule SE or Partnership Form 1065.

- Specify the apportioned percentage and calculate your net self-employment earnings by multiplying your earnings by the apportioned percentage.

- Subtract the allowable exclusion, not exceeding $400, from your net earnings.

- Calculate the transit district tax by applying the tax rate of 0.007437 to your net earnings subject to tax.

- Include any prepayments made during the tax year.

- Determine the total tax due or refund by completing the respective calculations according to the lines specified.

- Sign and date the form. If applicable, include the signature of the preparer.

- Save your changes and either download, print, or share the completed form according to your needs.

Complete your OR Form OR-TM online today to ensure compliance with your tax obligations!

Get form

Oregon tax forms are readily available online through the Oregon Department of Revenue's official website. The site provides easy access to various forms, including key documents you will need for taxes. If you are specifically looking for the OR Form OR-TM, you will find it listed among the relevant resources. This platform is designed for your convenience, making tax time less stressful.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.