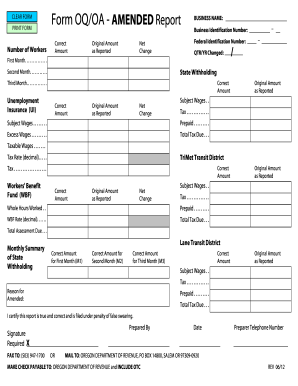

Get Or Dor Oq/oa 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OR DoR OQ/OA online

How to fill out and sign OR DoR OQ/OA online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Tax form completion can turn into a significant barrier and major nuisance if no proper assistance is given. US Legal Forms has been created as an online solution for OR DoR OQ/OA electronic filing and offers many benefits for taxpayers.

Utilize the instructions on how to complete the OR DoR OQ/OA:

Click the Done button in the top menu when you have finished. Save, download, or export the completed document. Use US Legal Forms to ensure secure and straightforward OR DoR OQ/OA completion.

- Locate the form on the website in the designated area or through the search tool.

- Press the orange button to launch it and wait until it’s finished.

- Examine the form and follow the instructions. If you have not filled out the form before, follow the line-by-line guidelines.

- Pay attention to the highlighted fields. These are editable and need specific information to be filled in. If you are uncertain about what to include, refer to the instructions.

- Always sign the OR DoR OQ/OA. Use the built-in feature to create the electronic signature.

- Click on the date field to automatically populate the current date.

- Review the form for accuracy and make adjustments before submitting.

How to modify Get OR DoR OQ/OA 2012: personalize forms online

Utilize our sophisticated editor to convert a basic online template into a finalized document. Continue reading to discover how to adapt Get OR DoR OQ/OA 2012 online effortlessly.

Once you locate an ideal Get OR DoR OQ/OA 2012, all you need to do is tailor the template to your specifications or legal necessities. Besides completing the fillable form with precise information, you may need to eliminate some clauses in the document that do not pertain to your situation. Alternatively, you might want to incorporate some absent conditions in the initial form. Our advanced document editing tools are the easiest method to rectify and modify the form.

The editor permits you to alter the content of any form, even if the file is in PDF format. You can insert and remove text, add fillable fields, and execute additional modifications while preserving the original formatting of the document. You can also rearrange the layout of the document by changing the order of pages.

You don't need to print the Get OR DoR OQ/OA 2012 to sign it. The editor includes electronic signature capabilities. Most forms already contain signature fields. Thus, you only need to affix your signature and request one from the other party needing to sign with just a few clicks.

Follow this detailed guide to create your Get OR DoR OQ/OA 2012:

After all participants finalize the document, you will receive a signed copy which you can download, print, and distribute to others.

Our solutions allow you to save a significant amount of time and minimize the likelihood of errors in your documents. Enhance your document workflows with efficient editing features and a robust eSignature solution.

- Open the desired form.

- Utilize the toolbar to customize the template to your liking.

- Complete the form providing precise information.

- Click on the signature field and insert your electronic signature.

- Send the document for signature to other parties if necessary.

Filing PA W-2 involves submitting the W-2 forms you've prepared to the Pennsylvania Department of Revenue. Ensure that you complete and review each form carefully to prevent any mistakes. You can file your W-2 online or via mail, depending on your preference. Using resources from US Legal Forms can make this process more manageable.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.