Get Dilorenzo & Company Supplemental Guidelines For Preparing Form W-2 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the DiLorenzo & Company Supplemental Guidelines for Preparing Form W-2 online

Filling out the DiLorenzo & Company Supplemental Guidelines for Preparing Form W-2 can seem daunting, but with clear instructions, you can complete it with confidence. This guide provides you with step-by-step instructions tailored to your needs for a seamless online experience.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

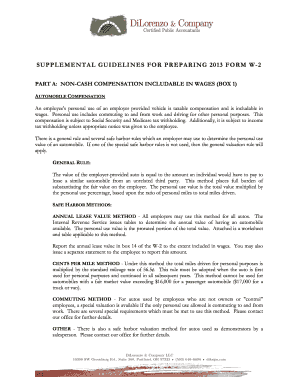

- Start by reading the guidelines completely to understand the components required for reporting non-cash compensation. Familiarize yourself with terms related to automobile compensation, life insurance, health insurance, disability insurance, and other relevant topics.

- In Part A, begin with the section for non-cash compensation includable in wages. Carefully calculate the personal use of any employer-provided vehicles using the applicable methods described (general rule, annual lease value method, cents per mile method, etc.).

- Gather data relating to life insurance costs. If any group term life insurance exceeds $50,000, compute the cost as outlined, and ensure you report it in Box 12 using code 'C'.

- For business expenses, distinguish between reimbursement types. Payments made under nonaccountable plans should be reported as wages in Box 1. Conversely, substantiated expenses under accountable plans should be noted in Box 12 with code 'L'.

- Review Part B related to informational reporting on Form W-2, particularly the requirements to report employer-sponsored health coverage costs under the Affordable Care Act in Box 12 with code DD.

- Ensure all figures are accurate and that you've included all necessary information regarding variable compensation types, such as moving expenses and deferred compensation plans.

- Finally, review and save your changes. You can choose to download, print, or share the completed form as needed.

Now that you have the necessary steps, take action and complete your documents online with ease.

Related links form

If you do not see any local income tax reported on your Form W-2, it might be due to a few factors. You may not have worked in a locality that imposes local taxes, or your employer might not be required to withhold local taxes based on your situation. To gain a comprehensive understanding, refer to the DiLorenzo & Company Supplemental Guidelines for Preparing Form W-2. Doing so can help clarify local taxation policies relevant to your work situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.