Get Irs 656-b 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 656-B online

Filing an Offer in Compromise with the IRS can be a vital step for individuals seeking to settle their tax debts. The IRS Form 656-B provides a comprehensive framework to help users navigate this process efficiently, especially when completed online. This guide will walk you through the essential components and steps required to effectively fill out the IRS 656-B form.

Follow the steps to successfully complete the IRS 656-B form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the necessary fields and begin your application.

- Provide your personal information in the designated sections, including your full name, Social Security Number, and contact details. Accurate data is critical for processing your offer.

- Indicate if you used the Offer in Compromise Pre-Qualifier tool before filling out the form. This step, while not mandatory, can help substantiate your eligibility and appropriate offer amount.

- Select your payment option in Section 4. You can choose either a Lump Sum Cash offer or a Periodic Payment option, which defines how you intend to repay your proposed offer amount.

- Detail your financial circumstances in Section 3, explaining your reason for the offer. You may need to provide documentation for any special circumstances affecting your ability to pay.

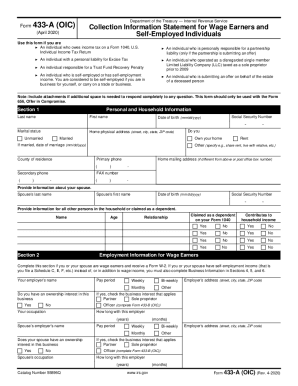

- Attach Form 433-A (OIC) or Form 433-B (OIC) based on whether you are an individual or a business, ensuring all necessary supporting documentation is included.

- Include your initial payment and application fee, if applicable, and ensure both checks are made payable to the 'United States Treasury.'

- Review your completed application checklist to ensure all forms are signed, and all necessary documents are included. This step can help prevent delays in processing.

- Mail the application package to the appropriate IRS facility based on your state of residence to ensure it arrives at the correct processing center.

- After mailing your application, monitor for any correspondence from the IRS, and respond promptly to any requests for additional information if necessary.

Start filling out your IRS 656-B online today to take a significant step towards resolving your tax debt!

Get form

The approval process for IRS abatement can vary significantly based on the complexity of your case. Generally, you might expect a response within 30 to 90 days after your submission of the IRS 656-B form. During busy seasons, processing times may lengthen, so it's advisable to stay proactive and check in on the status of your application.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.