Get Ok Frx 200 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OK FRX 200 online

How to fill out and sign OK FRX 200 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can become a significant challenge and considerable nuisance if adequate support is not available. US Legal Forms has been designed as an online solution for OK FRX 200 e-filing and provides various advantages for the taxpayers.

Follow the instructions on how to complete the OK FRX 200:

Click the Done button in the top menu when you have completed it. Save, download, or export the finished form. Use US Legal Forms to ensure a smooth and straightforward OK FRX 200 completion.

- Access the template on the website in the relevant section or through the Search engine.

- Click the orange button to open it and wait until it’s fully loaded.

- Review the form and pay close attention to the instructions. If you have never filled out the template before, adhere to the line-by-line guidance.

- Focus on the yellow fields. They are fillable and require specific information to be entered. If you’re uncertain about what details to provide, consult the instructions.

- Always sign the OK FRX 200. Utilize the built-in tool to create your e-signature.

- Click the date field to automatically insert the correct date.

- Review the form again to make any necessary changes before submission.

How to modify Get OK FRX 200 2014: tailor forms online

Eliminate the outdated approach of handling Get OK FRX 200 2014 on paper. Have the document filled out and endorsed in minutes using our expert online editor.

Are you compelled to alter and complete Get OK FRX 200 2014? With a powerful editor like ours, you can accomplish this in just a few minutes without needing to print and scan documents repeatedly.

We provide fully editable and user-friendly document templates that will help you start and finish the necessary document online.

All forms automatically include fillable fields that you can use as soon as you access the document. However, if you wish to refine the existing document content or insert something new, you can choose from a variety of editing and annotation tools. Emphasize, obscure, and comment on the text; include checkmarks, lines, text boxes, graphics, notes, and remarks. Moreover, you can swiftly authenticate the document with a legally binding signature. The finalized document can be shared with others, stored, imported into external applications, or converted into different formats.

Don’t waste time editing your Get OK FRX 200 2014 in the traditional manner - with pen and paper. Utilize our comprehensive tool instead. It offers a flexible array of editing options, integrated eSignature functionality, and user-friendliness. What sets it apart from similar solutions is the collaborative features - you can work together on documents with anyone, establish a well-organized document approval process from scratch, and much more. Test our online tool and maximize your investment!

- Simple to set up and use, even for those who have never filled out documents online before.

- Robust enough to cater to diverse editing requirements and document kinds.

- Safe and secure, ensuring your editing experience is protected at all times.

- Accessible across various operating systems, making it easy to complete the document from anywhere.

- Able to create forms from pre-designed templates.

- Compatible with multiple file formats: PDF, DOC, DOCX, PPT, and JPEG, among others.

Get form

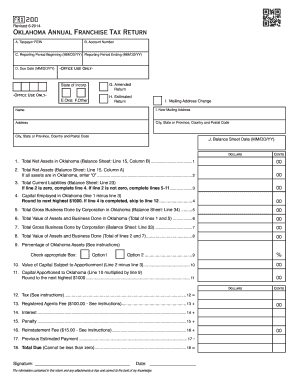

Oklahoma Form 200F, often referred to as OK FRX 200, is a crucial document for businesses operating within the state. It serves as the annual franchise tax report, ensuring that companies stay compliant with state regulations. By filing the OK FRX 200, you provide the necessary financial information about your business, helping maintain your good standing in Oklahoma. Utilizing platforms like uslegalforms can simplify this process and ensure accurate submission.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.