Loading

Get Irs 1040 Schedule R 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule R online

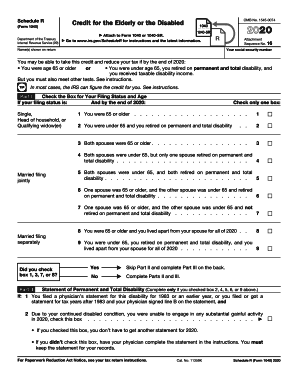

This guide provides a straightforward process for completing the IRS 1040 Schedule R form, designed to assist individuals claiming the credit for the elderly or the disabled. Whether you are new to filing taxes or looking for a refresher, this resource aims to make the process clearer and more manageable.

Follow the steps to successfully complete your Schedule R form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name and social security number at the top of the form. Ensure that the information matches what you provided on your main tax return.

- In Part I, check the box that corresponds to your filing status and age. If you are single, head of household, or a qualifying widow(er), check one of the first four boxes based on your age or disability status. If you are married, choose the appropriate option based on both spouses' ages or disability status.

- If applicable, complete Part II by checking the box to indicate whether you previously filed a physician’s statement regarding your disability. This step is only necessary if you have checked specific boxes in Part I.

- Move to Part III and determine your credit based on which boxes you checked in Part I. Enter the appropriate amounts according to the instructions provided.

- Follow the provided guidance to calculate any necessary amounts for line 11, which may require you to add or enter your taxable disability income based on your circumstances.

- Complete the subsequent lines carefully, making sure to include all relevant pensions, annuities, or disability income received in the year, whether taxable or not, as specified in the instructions.

- After filling out all lines and ensuring accuracy, review the completed form for any errors or omissions.

- Finally, save your changes, download the completed form, print it for your records, or share it as necessary to finalize your documentation.

Start filling out your IRS 1040 Schedule R form online today for a smoother filing experience.

A total disability means you are reasonably unable to carry out the normal functions of your usual job. It does not mean that you have to be completely physically unable to do any part of your job, but that your injury or illness is such that common sense requires you to stop working so you can focus on getting better.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.