Get Ca Ftb 540nr Instructions 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CA FTB 540NR Instructions online

How to fill out and sign CA FTB 540NR Instructions online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

As the tax season kicks off unexpectedly or perhaps you simply overlooked it, it could likely lead to complications for you. The CA FTB 540NR Instructions isn't the easiest to navigate, but there’s no need to fret regardless of the circumstances.

By utilizing our premier online software, you will discover how to complete the CA FTB 540NR Instructions even when time is critically limited. The sole requirement is to adhere to these straightforward directives:

With our comprehensive digital solution and its practical tools, accomplishing the CA FTB 540NR Instructions becomes more effortless. Don’t hesitate to engage with it and free up more time for hobbies and interests instead of paperwork.

- Access the file using our expert PDF editor.

- Provide all necessary details in the CA FTB 540NR Instructions, utilizing fillable fields.

- Add images, marks, checkboxes, and text boxes, if necessary.

- Repeated entries will be entered automatically after the first submission.

- If you encounter difficulties, activate the Wizard Tool. You will receive tips for a smoother completion.

- Remember to include the application date.

- Create your distinctive signature once and place it in the required spaces.

- Review the information you have entered. Rectify any errors if needed.

- Click on Done to finish editing and choose your sending method. You can opt for online fax, USPS, or email.

- You may also download the document for later printing or upload it to cloud storage like Google Drive, Dropbox, etc.

How to Alter Get CA FTB 540NR Directions 2013: customize forms online

Creating documents is easier with intelligent online tools. Eliminate paperwork with readily downloadable Get CA FTB 540NR Directions 2013 templates that you can modify online and print.

Drafting documents and forms should be more straightforward, whether it is a daily aspect of one’s job or sporadic tasks. When an individual needs to submit a Get CA FTB 540NR Directions 2013, researching rules and guides on how to fill out a form correctly and what it must contain may require significant time and energy. However, if you discover the appropriate Get CA FTB 540NR Directions 2013 template, completing a document will no longer be a struggle with an intelligent editor available.

Explore a wider array of features you can incorporate into your document workflow. There is no need to print, complete, and annotate forms manually. With a smart editing platform, all essential document processing features will always be accessible. If you aim to enhance your work process with Get CA FTB 540NR Directions 2013 forms, locate the template in the catalog, choose it, and uncover a more straightforward way to fill it out.

It is likewise simple to add custom visual components to the form. Utilize the Arrow, Line, and Draw tools to tailor the file. The more tools you are acquainted with, the easier it is to handle Get CA FTB 540NR Directions 2013. Experiment with the solution that provides everything crucial to locate and modify forms in one browser tab and forget about manual paperwork.

- If you want to insert text in a random area of the form or add a text field, utilize the Text and Text field tools and enlarge the text in the form as much as desired.

- Employ the Highlight tool to accentuate the main sections of the form.

- If you wish to conceal or eliminate certain text elements, make use of the Blackout or Erase tools.

- Personalize the form by incorporating default graphic elements. Use the Circle, Check, and Cross tools to add these features to the forms, as needed.

- For extra annotations, utilize the Sticky note tool and place as many notes on the forms page as necessary.

- Should the form require your initials or date, the editor has tools for that as well.

Get form

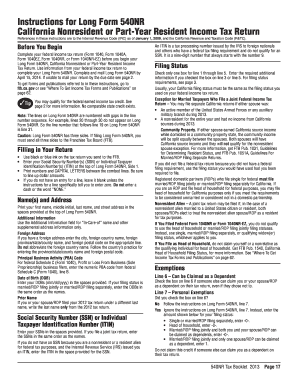

Determining your residency status involves evaluating where you lived during the tax year. If you spent six months or more in California, you are likely a resident. Conversely, if you lived elsewhere for the majority of the year and only earned income in California, you would be classified as a nonresident. Refer to the CA FTB 540NR Instructions for more detailed criteria.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.