Loading

Get Md At3-51 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD AT3-51 online

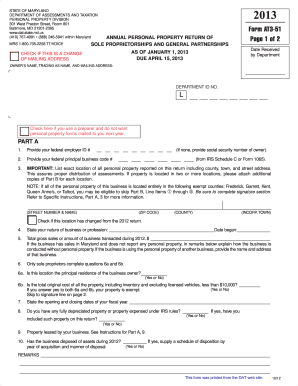

Filling out the MD AT3-51 form online can streamline your annual personal property return process. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully fill out the MD AT3-51 online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Enter the owner's name, trading as name, and mailing address in the appropriate fields. Ensure that the address is accurate to facilitate communication.

- Provide the federal employer identification number (EIN), or the social security number if no EIN is available. This is critical for identifying your business.

- Complete Part A, question 3 by listing the exact location of all personal property reported. If the property is in multiple locations, be prepared to attach additional copies of Part B.

- State the nature of your business or profession along with the date it began. This information is vital for assessment purposes.

- Report total gross sales for the previous year by filling out the related field. If your business does not have personal property, explain how it operates without it in the remarks section.

- For sole proprietors, answer questions 6a and 6b regarding residency and total property cost. If both are 'yes', your property may be exempt; you can skip to the signature section.

- Enter the opening and closing dates of your fiscal year. This helps the assessment department understand your financial reporting period.

- Indicate if you have any fully depreciated assets and whether they have been included in the return. This detail assists in assessing your current assets accurately.

- Complete Part B by listing the original costs and details of furniture, fixtures, equipment, and inventory as required. Ensure that totals are calculated correctly.

- Finally, review all entered information for accuracy, then provide signatures where required. Save your changes, download, print, or share the completed form as necessary.

Complete your MD AT3-51 form online today for a smooth submission process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To acquire your Maryland EIN number, visit the IRS website and complete the application process online. Ensure you have all necessary information about your business. This step is crucial for your MD AT3-51 filings and business operations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.