Get Oh Stec B (formerly Stf Oh41575f) 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OH STEC B (Formerly STF OH41575F) online

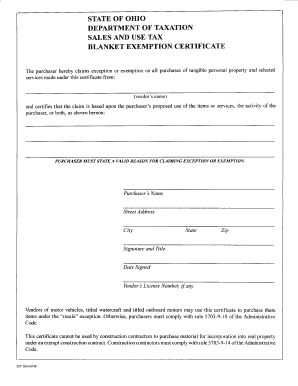

The OH STEC B, previously known as STF OH41575F, is an essential form for individuals and businesses claiming exemption from sales and use tax in Ohio. This guide provides step-by-step instructions on how to complete the form online, ensuring a smooth and efficient filing process.

Follow the steps to successfully complete the OH STEC B form online.

- Select the ‘Get Form’ button to access the OH STEC B form and open it in your preferred online document editor.

- Begin by filling in the purchaser's name in the designated field, ensuring it reflects the legal name of the individual or business claiming the exemption.

- Next, enter the street address of the purchaser, ensuring accuracy for correspondence purposes.

- Input the city, state, and zip code associated with the purchaser's address.

- In the signature field, the purchaser must sign their name, affirming the accuracy of the information provided. Alongside the signature, include the title of the signer, indicating their authority to complete the form.

- Fill in the date when the form is signed, ensuring it is current to avoid complications during processing.

- If applicable, provide the vendor's license number in the designated area to strengthen the exemption claim.

- Review all fields for accuracy before finalizing the form.

- Once confirmed, users can save their changes, download a copy of the form, print it for records, or share it as needed.

Complete your form online today to ensure your sales tax exemption is processed efficiently.

In Ohio, various organizations qualify for tax-exempt purchases, including non-profits, government entities, and educational institutions. Each category has specific requirements that must be met to obtain an OH STEC B (Formerly STF OH41575F). If you're unsure about your eligibility, consult with the Ohio Department of Taxation.

Fill OH STEC B (Formerly STF OH41575F)

Register online or find the forms needed to file for your business at OhioBusinessCentral.gov. Taxation tax.ohio.gov.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.