Loading

Get Oh It 1040 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH IT 1040 online

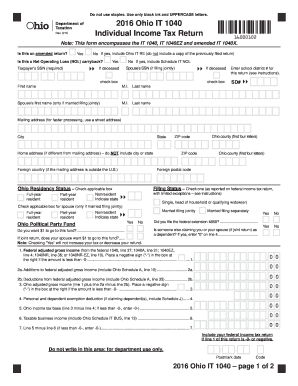

Filing your individual income tax return using the OH IT 1040 form can be straightforward when guided correctly. This comprehensive guide will help you navigate each section of the form, ensuring you complete it accurately and efficiently while filing online.

Follow the steps to effectively complete your OH IT 1040 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate whether this is an amended return by selecting 'Yes' or 'No'. If 'Yes', ensure to include Ohio IT RE, but do not include a copy of the previously filed return.

- If applicable, indicate if this is a Net Operating Loss (NOL) carryback by selecting 'Yes' or 'No'. If 'Yes', include Schedule IT NOL.

- Enter the taxpayer's Social Security Number (SSN) in the designated field.

- If filing jointly, provide the spouse’s SSN. If the spouse is deceased, check the appropriate box.

- Enter your school district number, ensuring to follow the instructions provided.

- Complete the personal information section by entering your first name, middle initial, and last name. Include your spouse’s name if filing jointly.

- Add your mailing address, city, state, zip code, and adjust to include if your home address differs from your mailing address.

- Indicate your Ohio residency status by checking the appropriate box: full-year resident, part-year resident, or nonresident.

- Select your filing status as reported on your federal income tax return from the provided options.

- Determine if you want to contribute $1 to the Ohio Political Party Fund by marking 'Yes' or 'No'.

- Fill out the income sections, including federal adjusted gross income and any necessary additions or deductions as outlined on the form.

- Calculate the Ohio income tax base by subtracting exemptions from your Ohio adjusted gross income.

- Continue filling out tax liability lines including total payments and credits, making sure to include any relevant supplemental forms.

- Review your completed form for accuracy before saving.

- Final steps involve saving changes, downloading a copy for your records, and sharing or printing as needed.

Start filling out your OH IT 1040 online today to ensure an efficient and accurate tax return process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can submit your 1040 online through various tax preparation platforms. Filing your OH IT 1040 electronically not only saves time but also enhances accuracy, as many tools offer error-checking features. Platforms like USLegalForms can guide you through the process smoothly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.