Loading

Get Nyc Tc201 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC TC201 online

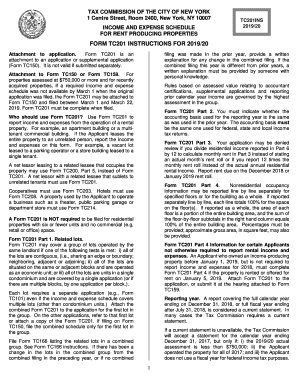

The NYC TC201 form is essential for reporting income and expenses for rent-producing properties. This guide provides a clear and supportive approach to filling out the form correctly and efficiently online.

Follow the steps to complete your NYC TC201 form accurately.

- Press the ‘Get Form’ button to access and open the form in your editor.

- Begin with Section 1: Property identification. Enter the required information, including borough, block, lot number, and any relevant details regarding whether the schedule covers multiple lots or special statuses.

- Proceed to Section 2: Current year reporting period and accounting basis. Indicate the accounting basis used (cash or accrual) and the reporting period.

- In Section 3: Residential occupancy, list the number of dwelling units categorized by type of occupancy along with monthly rents.

- Fill out Section 4: Nonresidential occupancy. Provide the approximate gross percentages of occupancy for different floors.

- Complete Section 5: Land or building lease information, specifying if the property is subject to an arms-length lease and provide details on the lessor and lessee.

- Move to Section 6: Income information. Report all income sources from the property, making sure to differentiate between regulated and unregulated residential income.

- In Section 7: Expense information, report actual operating expenses, ensuring that related party expenses are noted and itemized correctly.

- Continue with Section 8: Net profit or loss. Calculate the net income before and after deducting real estate taxes and complete the necessary calculations.

- In Section 9: Itemization of miscellaneous expenses, detail any additional expenses not covered in previous sections.

- Final step: Review your entries for accuracy, then save changes, download the completed form, or print it for submission.

Complete your NYC TC201 form online today to ensure accurate reporting and compliance with tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To reduce your NYC city tax liability, consider taking deductions and credits available to you. Utilizing forms like the TC201 can help lower your overall tax burden significantly. Additionally, engaging with tax preparation services, such as those offered by uslegalforms, can help identify and maximize available deductions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.