Loading

Get Nyc Dof Nyc-3l 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF NYC-3L online

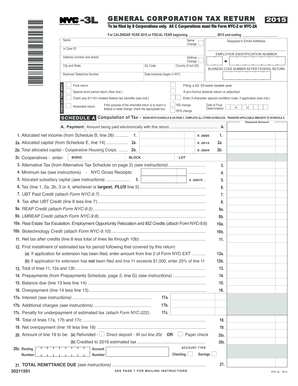

Filling out the NYC DoF NYC-3L form can seem challenging, but this guide will provide you with clear, step-by-step instructions tailored to your needs. This form is specifically designed for S Corporations to report their taxes.

Follow the steps to successfully complete the NYC DoF NYC-3L online.

- Click the ‘Get Form’ button to obtain the NYC DoF NYC-3L form and access it in your preferred editor.

- Begin by entering the corporation's name at the top of the form. Ensure the name matches the documents filed with the IRS.

- Complete the address section by filling out the number and street, city, state, country (if not the US), and zip code. Double-check that all information is accurate.

- Provide a business telephone number and the date the business began operating in New York City. This date is crucial for determining various tax requirements.

- Select the appropriate boxes indicating whether this is a final return, a special short period return, or an amended return due to federal or state changes.

- Fill in the employer identification number and business code number as per the federal return. Accurate entries are essential for your tax processing.

- Proceed to Schedule A for the computation of the tax. Follow the prompts to fill in allocated net income and allocated capital sections as indicated.

- Ensure to complete all other schedules required and transfer applicable amounts to Schedule A for further calculations.

- Review each section, ensuring that all calculations are correct, and that no information is missing.

- Once everything is filled out, save your changes, and choose to download, print, or share the completed form as necessary.

Complete your NYC DoF NYC-3L form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The 3L form is a tax return form required for unincorporated businesses in New York City. This document helps report income and calculate taxes owed to the city. Compliance with NYC DoF NYC-3L ensures you meet your tax obligations while benefiting from city services. Filing the 3L form correctly is essential for accountability and financial transparency.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.