Loading

Get Ga Dor It-app 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR IT-APP online

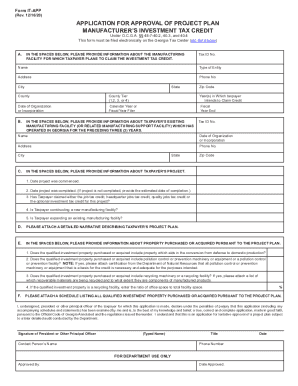

Filling out the GA DoR IT-APP is essential for taxpayers seeking approval for the investment tax credit on manufacturing projects. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the GA DoR IT-APP online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In section A, provide the requested information about the manufacturing facility, including tax ID number, name, type of entity, address, and contact details. Make sure to include the county tier and years in which you intend to claim the credit.

- In section B, enter information about your existing manufacturing facility, ensuring it has operated in Georgia for the past three years. Provide necessary details such as tax ID number, name, and address.

- Proceed to section C and describe the project. Include the commencement and completion dates, and indicate whether you have claimed any related job tax credits. Specify if you are constructing a new facility or expanding an existing one.

- Section D requires you to attach a detailed narrative describing your project plan. This narrative should explain how the investment relates to your manufacturing operation.

- In section E, answer questions regarding the property purchased or acquired under the project plan. Include details about pollution control machinery and recycling facilities, as required.

- Lastly, attach a schedule listing all qualified investment property purchased. Ensure it includes type, quantity, purchase date, and other relevant values.

- After completing all sections and attaching necessary documents, review your entries for accuracy. You can then save changes, download, print, or share the form as needed.

Complete your application online today to take advantage of the investment tax credit.

You can file any number of state returns with your federal return or after it has been accepted. ... If your federal return was e-filed using our software and has been accepted by the IRS, you can e-file more state tax returns without e-filing your federal return again.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.