Get Nyc Dof Cr-a 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF CR-A online

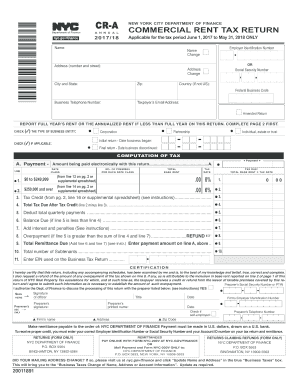

Filling out the NYC Department of Finance Commercial Rent Tax Return (CR-A) can appear challenging, but with clear guidance, users can navigate the process smoothly. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the NYC DoF CR-A form online.

- Click ‘Get Form’ button to obtain the CR-A online and open it in your editor.

- Begin by entering your name in the designated field. This should reflect the name of the person or entity filing the return.

- Provide the address of the business, including the number and street, city, state, and zip code.

- Enter the business telephone number and the taxpayer’s email address for communication purposes.

- Input the Employer Identification Number (EIN) or Social Security Number (SSN) depending on the type of entity filing the form.

- Indicate the type of business entity by checking the appropriate box such as Corporation, Partnership, or Individual.

- If applicable, specify whether this is an initial or final return and provide the associated dates.

- Report the total amount of rent for the year or annualized rent for a lesser period on Page 1, completing page 2 if there are additional premises.

- Complete the Computation of Tax section where you will calculate the tax due based on the provided rates and deductions.

- Complete the certification section, including the signature, title, and date of the officer submitting the form.

- Review all entries for accuracy before saving your changes. Once completed, you can download, print, or share the form as needed.

Complete your NYC DoF CR-A online today for a smooth filing experience.

Get form

Related links form

NYC DOF Tax Class 1 primarily includes residential properties that house one to three families. This class benefits from comparatively lower tax rates, making it easier for homeowners to manage their finances. Understanding this classification is essential for homeowners, especially when considering their obligations under the NYC DoF CR-A. If you have more questions or need assistance, the NYC DOF can provide clarity.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.