Get Ny Request Update Class 1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY Request Update Class 1 online

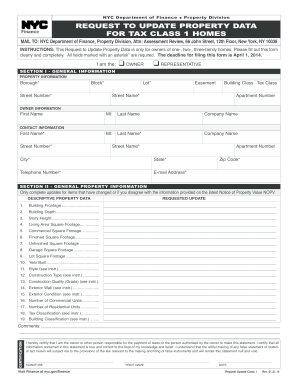

Filling out the NY Request Update Class 1 form is essential for property owners who need to update the descriptive data of their property as listed in the Notice of Property Value. This guide provides step-by-step instructions for completing the form online, ensuring that all necessary information is accurately provided.

Follow the steps to complete the form accurately.

- Use the ‘Get Form’ button to access the form and open it in your editing tool.

- Begin with Section I - General Information. Fill in the required fields marked with an asterisk*. Enter the property information, including the borough, street number, and block. If applicable, provide the owner information, including first name and last name.

- Next, complete the contact information section. This includes entering the first name, street number, city, street name, telephone number, email address, state, and zip code. Make sure to fill out all required fields.

- Proceed to Section II - General Property Information. Only update items that have changed or if you disagree with the information on the latest Notice of Property Value. Write your changes in the Requested Update column.

- Fill in descriptive property data, including building frontage, building depth, story height, living area square footage, commercial square footage, finished square footage, unfinished square footage, garage square footage, and lot square footage.

- Continue by providing the year the building was constructed and select the style, construction type, construction quality, exterior wall, and exterior condition from the provided options.

- Indicate the number of commercial units and residential units. Finally, fill in the property tax classification according to the provided definitions.

- In the Requests Update section, clearly write down any requests for updates regarding your property data.

- Complete the certification section, ensuring all information is correct. Sign, print your name, and date the form.

- Once you have filled out the form, you can save your changes, download the document, print it, or share it as needed.

Complete your property update request online today for accurate tracking of your property data.

Get form

To change your mailing address on your NYC property tax bill, you can submit a completed Address Change Form to the Department of Finance. This ensures that future tax bills and notices are sent to the correct address. Keep in mind that processing may take some time, so it is best to address it promptly. If you prefer assistance with the form, check out US Legal Forms for a user-friendly solution.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.