Loading

Get Ny Request Update Class 1 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY Request Update Class 1 online

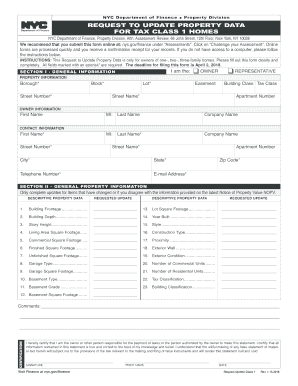

This guide provides essential information and step-by-step instructions for completing the NY Request Update Class 1 form online. Designed for owners of one-, two-, or three-family homes, this form allows you to update property data accurately and efficiently.

Follow the steps to fill out your form correctly.

- Click ‘Get Form’ button to access the NY Request Update Class 1 form and open it in your browser.

- In Section I, enter the property information, including the borough, street number, block, and lot numbers. All fields marked with an asterisk (*) are mandatory to complete.

- Provide owner information by including your first name, last name, and if applicable, your company name. Don’t forget to indicate if you are the owner or a representative.

- Fill in your contact information, which includes telephone number, email address, and full address with city, state, and zip code.

- Proceed to Section II and only complete updates for items that have changed or if you disagree with the information provided on your latest Notice of Property Value (NOPV). Write any changes in the 'Requested Update' column.

- For each descriptive property data section (like building frontage, depth, and others), fill out the requested information based on any changes or agreements with the existing data.

- In the certification section, read the statement carefully and ensure that the information provided is accurate. Then, sign and print your name, along with the date.

- Once completed, save the changes to your form. Users can download, print it, or share it as needed.

Complete your forms online to ensure timely processing and receive a confirmation for your records.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Class 1 property in NYC encompasses residential properties with one to three units, generally owner-occupied or used as rentals. This classification typically enjoys favorable tax treatment, making the NY Request Update Class 1 a valuable resource for ensuring property owners are utilizing their benefits effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.