Loading

Get Canada Td1 E 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada TD1 E online

Navigating tax forms can be challenging, but filling out the Canada TD1 E form online can make the process easier for you. This guide will provide you with step-by-step instructions to ensure you complete the form accurately and effectively.

Follow the steps to successfully fill out the Canada TD1 E form online.

- Start by pressing the ‘Get Form’ button to access the Canada TD1 E form and open it in your chosen editor.

- Begin filling in your last name, first name, and initials in the appropriate fields. Make sure to enter your address and postal code accurately.

- In the next section, provide your date of birth in the format YYYY/MM/DD and your social insurance number.

- For non-residents, specify your country of permanent residence if applicable.

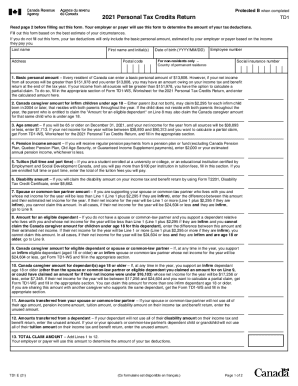

- Fill out the basic personal amount on Line 1. Ensure you consider your net income and any necessary calculations based on your circumstances.

- Proceed to Line 2 to claim the Canada caregiver amount for any infirm children under 18 who reside with both parents.

- Complete Line 3 if you are aged 65 or older, entering the appropriate age amount based on your net income.

- If you receive pension payments, report the pension income amount in Line 4.

- Students should fill out Line 5 with the total tuition fees paid if over $100 per institution.

- If applicable, enter the disability amount on Line 6.

- In Line 7, enter the amount for your spouse or common-law partner, adjusting for their net income as necessary.

- For dependants living with you, use Line 8 to enter any eligible amounts based on their net income.

- Continue to Lines 9 through 12 to claim other caregiver amounts, transferred amounts from your spouse or dependants, as applicable.

- Calculate the total claim amount by adding up the values from Lines 1 to 12 and enter this on Line 13.

- Finally, review your form for accuracy. Save your changes, and then download, print, or share the completed form with your employer or payer.

Complete your tax documents online today and ensure you're accurately reporting your details.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Non-refundable tax credits All taxpayers can claim a basic non-refundable tax credit for their income tax, known as the personal amount. It is adjusted annually to allow for inflation and other factors, but in 2019 the personal amount for federal taxes was $12,069.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.