Get Ny Nys-45-x 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY NYS-45-X online

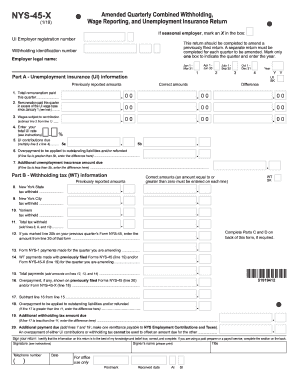

The NY NYS-45-X form is used to amend a previously filed quarterly combined withholding, wage reporting, and unemployment insurance return. This guide provides detailed and clear instructions on how to complete this form online, ensuring that you accurately report your information.

Follow the steps to accurately complete the NY NYS-45-X form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate your seasonal employer status by marking an X in the appropriate box if applicable.

- Enter your UI employer registration number, with withholding identification number, and employer legal name in the relevant fields.

- Select the quarter you are amending by marking only one box and entering the corresponding year.

- In Part A, report previously reported amounts for total remuneration, remuneration exceeding the UI wage base, and wages subject to contribution. Calculate the correct amounts and enter them in the designated fields.

- Provide the total UI rate in the field provided, then calculate the UI contributions due by multiplying the wages subject to contribution by the UI rate.

- If applicable, report any overpayment or additional unemployment insurance amounts to be applied or refunded.

- In Part B, fill in the amounts for New York State, New York City, and Yonkers taxes withheld. Ensure that each amount is zero or more.

- Calculate the total tax withheld by adding the amounts from the three categories and report them accordingly.

- Complete Parts C and D, if necessary, for amended employee wage and withholding information or corrections/additions to previous forms.

- Certify your return by signing, providing your contact information, and the date. Ensure a paid preparer section is filled out if applicable.

- Review the completed form for accuracy, save your changes, and choose to download, print, or share the form as needed.

Complete your NY NYS-45-X form online to ensure accurate reporting and compliance.

Related links form

Yes, you can file an amended NYS-45 online, which makes correcting any errors in your previous filings more convenient. The New York State Department of Labor allows you to submit amendments electronically, streamlining the process and providing immediate confirmation of your updates. Consider using resources like US Legal Forms to assist in ensuring that your amendments are filed correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.