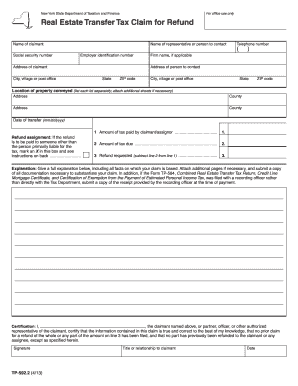

Get Ny Dtf Tp-592.2 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF TP-592.2 online

How to fill out and sign NY DTF TP-592.2 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans prefer to handle their own tax returns and also to complete reports electronically.

The US Legal Forms online platform simplifies the e-filing process for the NY DTF TP-592.2, making it quick and straightforward.

Ensure that you have accurately completed and submitted the NY DTF TP-592.2 on time. Consider any relevant deadlines. Providing incorrect information on your tax documents may lead to significant penalties and issues with your annual tax return. Use only reliable templates from US Legal Forms!

- Open the PDF form in the editor.

- Look at the highlighted fillable areas where you can enter your information.

- Select options when presented with checkboxes.

- Utilize the Text icon and additional advanced features to personalize the NY DTF TP-592.2 manually.

- Review all details carefully prior to signing.

- Generate your personalized eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

- Sign the document electronically and indicate the date.

- Click on Done to continue.

- Save or send the document to the recipient.

How to modify Get NY DTF TP-592.2 2013: personalize forms online

Utilize our all-inclusive editor to transform a basic online template into a finalized document. Continue reading to discover how to alter Get NY DTF TP-592.2 2013 online effortlessly.

Once you locate the suitable Get NY DTF TP-592.2 2013, you simply need to modify the template to fit your preferences or legal obligations. Besides filling out the interactive form with precise details, you may have to remove some clauses in the document that are not pertinent to your situation. Alternatively, you might want to include some absent stipulations in the original form. Our sophisticated document editing functionalities are the easiest method to amend and modify the document.

The editor allows you to alter the content of any form, even if the document is in PDF format. You can add and delete text, insert fillable fields, and make further adjustments while preserving the original document's formatting. You can also rearrange the layout of the document by altering the page sequence.

You don't need to print the Get NY DTF TP-592.2 2013 to sign it. The editor comes with electronic signature capabilities. Most forms already contain signature fields. So, you just need to append your signature and request one from the other signatory with a few clicks.

Follow this detailed guide to produce your Get NY DTF TP-592.2 2013:

Once all parties have signed the document, you will receive a signed copy that you can download, print, and distribute to others.

Our services enable you to save substantial time and minimize the likelihood of errors in your documents. Enhance your document workflows with effective editing features and a robust eSignature solution.

- Open the desired form.

- Utilize the toolbar to modify the form to your liking.

- Complete the form with accurate details.

- Click on the signature field and insert your electronic signature.

- Send the document for signature to other signers if needed.

Get form

The TP 584 form is utilized to report the transfer of real estate in New York City. This form gathers necessary information regarding the transfer for tax calculation and recording. To streamline this process and ensure all requirements are met, refer to the information laid out in the NY DTF TP-592.2.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.