Loading

Get Indiana State Form 12662

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indiana State Form 12662 online

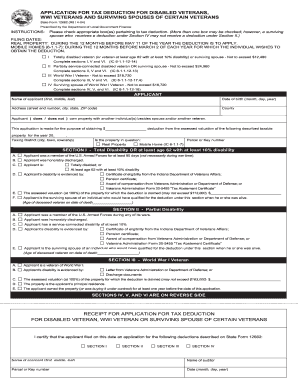

This guide provides a clear, step-by-step approach to filling out the Indiana State Form 12662 online. Whether you are a veteran, a surviving spouse, or a representative, this guide will help you navigate the necessary sections of the application for tax deduction.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully review the section that applies to your situation: choose between total disability, partial disability, World War I veteran, or surviving spouse. Make sure to read the specific requirements in each section.

- Fill out your personal details in the applicant section, including your name, date of birth, address, county, and ownership status of the property.

- In the relevant section, provide information about your service, discharge status, and disability evidence. Ensure all required documentation is included.

- For the assessed valuation of the property, fill in the amount accurately, ensuring it does not exceed the limits specified for your category.

- Complete any additional questions related to property ownership and previous deductions, ensuring they are truthful and thorough.

- Verify that all provided information is correct, sign the application, and make note of the filing date.

- Once completed, save your changes, and you can choose to download, print, or share the form as needed.

Begin filling out your Indiana State Form 12662 online today to secure your tax deductions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file for a homestead exemption in Indiana, you will need several documents, including proof of residency and identification. Additionally, you must complete the Indiana State Form 12662 and submit it to your local county assessor's office. Ensuring you have all necessary materials will simplify the filing process and help you secure your exemption.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.