Get Ca Ftb 540 1991

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

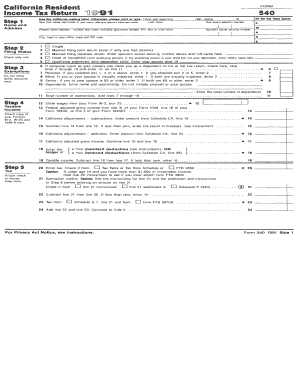

How to fill out the CA FTB 540 online

Filling out the CA FTB 540 form online is an essential step for individuals to report their income and calculate their tax liability. This guide provides clear, step-by-step instructions to help you navigate the process seamlessly.

Follow the steps to complete your CA FTB 540 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information, including your name, address, and Social Security number. Ensure that all details are accurate to prevent processing delays.

- Complete the income section. This includes reporting various sources of income such as wages, interest, and dividends. Double-check your figures for accuracy.

- Fill out the deductions and credits section. Include any eligible deductions that might lower your tax bill, such as mortgage interest or educational expenses.

- Review the tax calculation section. Ensure that the calculated tax reflects your reported income and eligible deductions.

- Provide information about any payments you have made throughout the year, such as estimated tax payments or withholdings from your paycheck.

- Finish by reviewing your entire form for completeness and accuracy. Ensure all fields are filled and verify your calculations.

- Once satisfied with your entries, you can save changes, download, print, or share the completed form as needed.

Start completing your CA FTB 540 online today for a smooth filing experience.

Get form

Related links form

California state income tax form 540 is the primary document required for filing personal income taxes by residents of California. This form allows you to report your total income, calculate your tax liability, and make claims for deductions and credits. Completing the CA FTB 540 accurately is essential for receiving your tax refund and fulfilling your state obligations. Utilizing USLegalForms can provide you with useful templates and guidance throughout the process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.