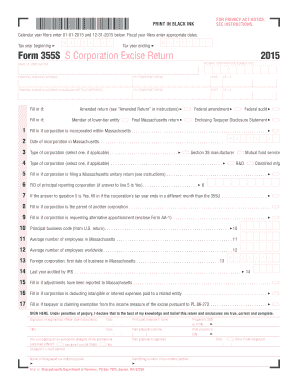

Get Ma Dor 355s 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MA DoR 355S online

How to fill out and sign MA DoR 355S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your earnings and submitting all necessary tax documentation, including MA DoR 355S, is solely the obligation of a US citizen.

US Legal Forms simplifies your tax administration, making it more accessible and precise.

Store your MA DoR 355S securely. Ensure that all your pertinent documents and records are organized properly while being aware of the deadlines and tax rules established by the Internal Revenue Service. Make it simple with US Legal Forms!

- Obtain MA DoR 355S via your internet browser on your device.

- Access the fillable PDF document with a click.

- Begin filling in the template field by field, adhering to the instructions of the advanced PDF editor's interface.

- Input text and numbers accurately.

- Choose the Date field to automatically insert the current day or modify it manually.

- Utilize the Signature Wizard to create your personalized e-signature and sign in just a few minutes.

- Refer to IRS guidelines if you have any remaining questions.

- Click on Done to preserve the changes.

- Proceed to print the document, save it, or share it via Email, SMS, Fax, USPS without leaving your web browser.

How to modify Get MA DoR 355S 2015: personalize documents online

Handling documentation is simple with intelligent online resources. Eliminate paperwork with easily accessible Get MA DoR 355S 2015 templates that you can modify online and print.

Creating documents and forms should be more accessible, whether it is a routine aspect of one’s profession or sporadic tasks. When an individual needs to submit a Get MA DoR 355S 2015, reviewing guidelines and instructions on how to accurately complete a form and what it should encompass can consume a significant amount of time and energy. However, if you discover the right Get MA DoR 355S 2015 template, completing a document will cease to be a challenge with a clever editor available.

Explore a broader array of features you can incorporate into your document management routine. No longer is it necessary to print, fill in, and annotate forms by hand. With an intelligent editing platform, all essential document processing functionalities will always be accessible. If you wish to enhance your workflow with Get MA DoR 355S 2015 forms, locate the template in the catalog, click on it, and uncover a simpler way to complete it.

The more functionalities you are acquainted with, the simpler it is to manage Get MA DoR 355S 2015. Experiment with the solution that offers all necessary tools to locate and modify forms within a single tab of your browser and eliminate manual paperwork.

- If you need to insert text at any position within the form or add a text field, utilize the Text and Text field tools to extend the text in the form as needed.

- Utilize the Highlight tool to emphasize the crucial elements of the form. If you need to hide or eliminate certain pieces of text, apply the Blackout or Erase tools.

- Personalize the form by incorporating standard graphic elements. Use the Circle, Check, and Cross tools to include these components in the forms when required.

- For additional remarks, utilize the Sticky note tool to place as many notes on the forms page as necessary.

- If the form requires your initials or the date, the editor provides tools for that as well. Minimize the risk of mistakes using the Initials and Date tools.

- Custom graphic elements can also be added to the form. Use the Arrow, Line, and Draw tools to modify the document.

Get form

You should mail your Massachusetts tax form to the mailing address indicated on the form’s instructions. Each form may have a specific destination depending on the type of tax and your business structure. Always verify the correct mailing information on the Massachusetts Department of Revenue's website to ensure timely processing. Furthermore, consider using a mail service that provides delivery confirmation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.