Loading

Get Ca Ftb 540 1997

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 540 online

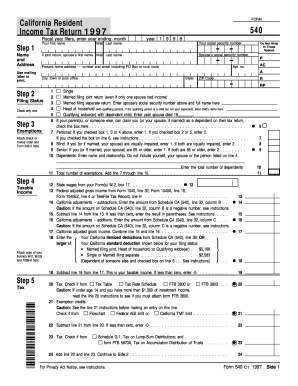

This guide provides clear instructions for filling out the California Resident Income Tax Return (CA FTB 540) online. Users will find step-by-step directions tailored to ensure a smooth and accurate filing experience.

Follow the steps to complete your CA FTB 540 online.

- Press the ‘Get Form’ button to acquire the CA FTB 540 and open it in your preferred viewing tool.

- Begin with the Name and Address section. Enter your first name, initial, last name, and your social security number. If applicable, repeat this for your spouse, ensuring to include their social security number too.

- In the Filing Status section, check only one option that reflects your current filing situation: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Proceed to the Exemptions section. Enter the total number of exemptions, which may include personal exemptions and dependent claims. Attach any necessary checks or forms as indicated.

- Next, move to the Income section. Enter your state wages and federal adjusted gross income. If applicable, enter California adjustments, ensuring to follow the provided cautionary notes if they apply.

- Calculate your taxable income by subtracting your deductions from your adjusted gross income. It is essential to follow the instructions carefully for this stage.

- Transition to the Tax section. Check the relevant sources for tax calculations and make exemptions as necessary. Ensure you correctly tally any additional tax based on lump-sum distributions or other specific criteria.

- Fill out the Credits section, specifying any credits you are claiming. Make sure to calculate any potential contributions towards special funds if you wish to do so.

- Review the Payments section, where you will include any California income tax withheld and any estimates for future payments.

- Lastly, conclude your form by calculating any overpayment or tax owed. Ensure to sign and date the form, and if applicable, include your spouse's signature for joint filings.

Don't wait any longer; complete your CA FTB 540 online today to ensure timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To find California's adjusted gross income, refer to your completed CA FTB 540 form, which consolidates your income information. You can also determine your AGI by reviewing your tax documents and considering applicable state adjustments. If this process seems complex, our uslegalforms can provide insights and resources to simplify it.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.