Get Ny Dtf Dtf-5 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF DTF-5 online

This guide provides clear instructions on how to successfully complete the NY DTF DTF-5 form online. By following these steps, users can effectively submit their financial information required for payment plans or offers in compromise.

Follow the steps to fill out the NY DTF DTF-5 form online.

- Click ‘Get Form’ button to access the form and open it in an online editing tool.

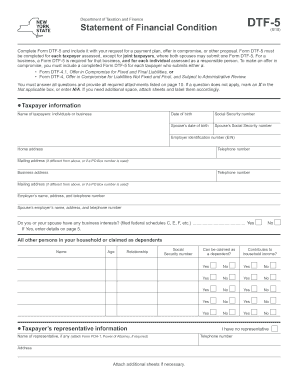

- Provide taxpayer information. Enter the name of the taxpayer, date of birth, Social Security number, and if applicable, the spouse’s details including date of birth and Social Security number.

- Fill in the home address and contact numbers. Make sure to provide a mailing address if it differs from the home address.

- Indicate if there are any business interests by marking 'Yes' or 'No' and provide details if applicable.

- List all household members or dependents, their names, ages, relationships, Social Security numbers, and whether they contribute to household income or can be claimed as dependents.

- Enter taxpayer representative information, if applicable. Attach Form POA-1, Power of Attorney, if necessary.

- Complete the assets section by providing the current balance for cash on hand, bank accounts, brokerage accounts, retirement accounts, and other relevant asset types.

- Detail liabilities, including any loans, mortgages, and judgments. Ensure accuracy in the amounts noted.

- Fill in household income and expenses, listing income sources and estimated monthly expenses to provide a comprehensive financial overview.

- Attach any required documents specified on the form. These may include federal tax returns, bank statements, and other relevant financial documentation.

- Review all information for accuracy. Once verified, complete the declaration section by signing and dating the form.

- After filling out the form, users can save changes, download the completed document, print it, or share it as necessary.

Complete your NY DTF DTF-5 form online today to ensure a smooth submission process.

The NY State Tax Amnesty Program offers a limited time for taxpayers to resolve their outstanding tax liabilities without penalties or interest. This program exists to encourage compliance and help collect revenue for the state effectively. While navigating the NY DTF DTF-5 processes, you will see the benefits of this program. Engaging with uslegalforms can simplify your understanding and participation in this amnesty opportunity.

Fill NY DTF DTF-5

Complete Form DTF-5 and include it with your request for a payment plan, offer in compromise, or other proposal. New York State Department of Taxation and Finance. This form helps the New York State Department of Taxation and Finance understand your financial situation. Our tax professionals stand in on behalf of a taxpayer (Individual or Business) during an Internal Revenue Service tax collection or audit case. Download Statement of Financial Condition (DTF-5) – Department of Taxation and Finance (New York) form. They are required to fill it out personally. Taxpayers agree that during the five-year period, beginning with the date we accept the offer, to comply with all provisions of the New York State Tax Law. Q: Who needs to file Form DTF-5? A: Certain businesses in New York are required to file Form DTF-5 to provide information about their financial condition. Taxpayers agree that during the five-year period, beginning with the date we accept the offer, to comply with all provisions of the New York State Tax Law.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.