Get Ny Dtf Dtf-17 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF DTF-17 online

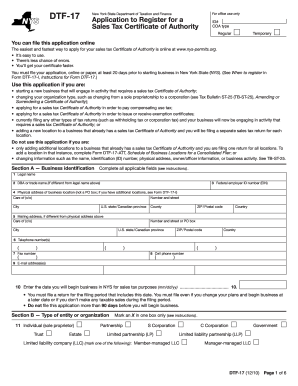

Filing the NY DTF DTF-17 form is a crucial step for individuals and businesses seeking a sales tax Certificate of Authority in New York. This guide provides clear, step-by-step instructions to help you complete the form online with accuracy and confidence.

Follow the steps to fill out the NY DTF DTF-17 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out Section A - Business identification. Provide your legal name, DBA or trade name, federal employer ID number (EIN), physical address, mailing address if different, telephone number(s), fax number, cell phone number, and email address. Be sure to enter the date you will begin business in New York State for sales tax purposes.

- Complete Section B - Type of entity or organization. Mark an X in only one box to indicate your entity type, such as individual, partnership, corporation, or LLC.

- In Section C - Business information, indicate how you will file your sales tax returns and provide any relevant ID numbers if applicable.

- For Section D - Business activity, mark an X for the goods and services you intend to sell and provide relevant licensing details, if applicable.

- Section E - Account and reporting information requires you to enter details for the bank account where sales tax money will be deposited, as well as whether you intend to accept credit cards.

- Provide a brief description of your business activities in Section F. Include your principal and secondary NAICS codes.

- Section G - Responsible person(s) requires you to list all responsible individuals associated with the business. Complete all necessary fields, including SSNs.

- In Section I - Signature of responsible person, certify the information provided is accurate. This section must be completed and signed to prevent the application from being returned due to missing information.

- Once all sections are completed, review the form for accuracy, save your changes, and proceed to download, print, or share the filled-out form.

Complete your NY DTF DTF-17 form online today to expedite your sales tax registration process.

No, a sales tax permit is not the same as a tax-exempt certificate. The sales tax permit allows businesses to collect sales tax from customers, while the tax-exempt certificate enables qualifying purchases to be made without tax. Recognizing the difference, especially in relation to the NY DTF DTF-17 form, helps businesses navigate their tax obligations successfully. Both documents play distinct roles in tax compliance and should be managed carefully.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.