Get Ca Ftb 3885 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3885 online

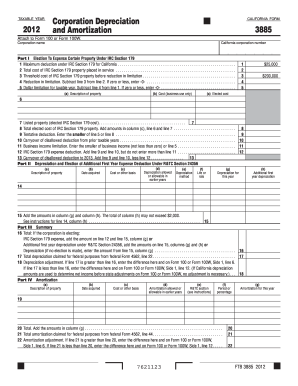

This guide provides a clear and user-friendly approach to filling out the CA FTB 3885 form online. Understanding each section and field will help ensure accurate completion of your corporation's depreciation and amortization tax calculations.

Follow the steps to successfully complete the CA FTB 3885 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I by entering the maximum deduction under IRC Section 179 for California in the designated field. This amount reflects the cap set for your eligible Section 179 property expenses.

- In the next field, provide the total cost of all IRC Section 179 property that has been placed in service during the taxable year. Ensure that it reflects only the business-related expenses.

- Next, input the threshold cost for IRC Section 179 property before any reduction in limitation occurs. This requires careful attention to the previous costs.

- For any limitations, subtract the total cost entered in step 3 from the threshold cost in step 4. If the result is zero or less, ensure you enter ‘-0-’.

- Proceed to complete the dollar limitation for the taxable year by subtracting the reduction calculated in step 5 from the maximum deduction from step 1.

- Fill out columns for the description and cost of each asset elected for Section 179. Be specific to ensure clarity on each asset being depreciated.

- Continue to summarize the total elected costs in the appropriate column, ensuring you also include listed property if applicable.

- In Part II, provide details for the depreciation method chosen, entering descriptions, costs, and methods for each asset as required.

- Complete any necessary fields in Part III summarizing total depreciation and ensuring all calculations align with prior federal submissions.

- Lastly, review all entries for accuracy and completeness. Users may then save changes, download, print, or share the completed form.

Start completing your CA FTB 3885 form online today for accurate tax reporting.

Get form

Related links form

To claim exemption from California withholding, you will need to submit the appropriate forms to the California Franchise Tax Board, including the CA FTB 3885. Generally, this involves verifying that you meet specific criteria set by California tax regulations. Accurately completing the required forms facilitates a smoother transaction process. For comprehensive assistance, uslegalforms provides resources that simplify the exemption process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.