Loading

Get La Dor R-3405 2002-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA DoR R-3405 online

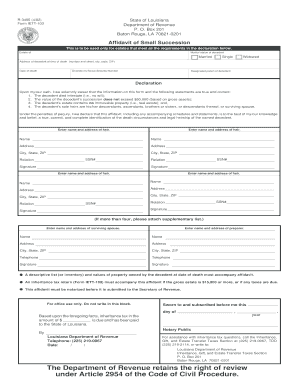

The LA DoR R-3405 form, also known as the affidavit of small succession, is essential for handling the estate of a decedent under specific conditions. This guide provides clear and supportive instructions on how to complete the form online effectively.

Follow the steps to complete the LA DoR R-3405 form.

- Press the ‘Get Form’ button to access the form and open it in your document editor.

- Begin by filling out the estate of the decedent in the designated section. Provide their marital status by selecting the appropriate option: Married, Single, or Widowed.

- In the next field, enter the address of the decedent at the time of death, including the number and street, city, state, and ZIP code.

- Enter the date of death in the specified format.

- Fill in the decedent’s Social Security Number accurately.

- Indicate the designated parish of the decedent in the section provided.

- Read and confirm the declaration statements regarding the decedent's estate. Ensure that the information is correct, especially mentioning that the decedent died intestate and that the estate value does not exceed $50,000.

- List the names and addresses of all heirs, ensuring to fill in their corresponding Social Security Numbers and relationships to the decedent.

- Obtain the required signatures from all parties involved in the declaration.

- If there are more than four heirs, attach a supplementary list as necessary.

- Complete the sections for the surviving spouse and the preparer by entering their names, addresses, and phone numbers.

- Ensure you have a descriptive list (or inventory) and values of the decedent's owned property at the date of death to accompany the affidavit.

- If applicable, include the inheritance tax return (Form IETT-100) if the gross estate is $15,000 or more, or if any taxes are due.

- Before submitting the completed affidavit, ensure it is notarized as required.

- Finally, save changes, and download or print the completed form for your records.

Complete and submit your LA DoR R-3405 document online today.

Related links form

To obtain tax-exempt status in Louisiana, you must meet specific criteria, which typically includes submitting the appropriate applications to the state authorities. Understanding exemptions under LA DoR R-3405 can help guide you through this process. Consider consulting with a tax professional to ensure compliance with all regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.