Loading

Get Ny Dof Cr-q2 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DoF CR-Q2 online

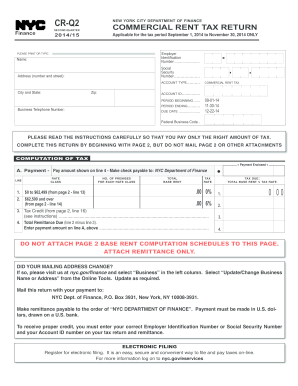

Filling out the NY DoF CR-Q2 form is essential for reporting your commercial rent tax obligations for the specified period. This guide will provide you with a clear, step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to complete your NY DoF CR-Q2 form online.

- Click ‘Get Form’ button to access the NY DoF CR-Q2 form and open it in your editor of choice.

- Begin by entering your Employer Identification Number or Social Security Number at the designated field. This information is necessary for identifying your tax account and ensuring proper credit.

- Fill in your name and address including the number and street, city, state, and zip code. It is important that this information accurately reflects your current business location.

- Provide your business telephone number and ensure it is correct for any necessary communication regarding your tax return.

- Indicate the account type and account ID in their respective fields. This information ensures that your payment and submission are applied correctly.

- Complete the period beginning and ending fields reflecting the specified tax period of September 1, 2014, to November 30, 2014.

- Review the computation of tax section. Here you will input the total base rent from page 2, the tax rate applicable, and any other necessary calculations based on your rental income.

- Input your deductions in the total deductions section. Accurately calculate any rent applied to residential use, and other possible deductions to ensure financial accuracy.

- Once all calculations are complete, determine your total remittance due by subtracting any tax credits from the calculated tax.

- Finally, save your changes and choose to download, print, or share the form as needed. Ensure that you have a copy for your records before mailing your payment.

Complete your NY DoF CR-Q2 form online today to ensure timely filing and compliance with commercial rent tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Businesses operating within New York City are generally subject to NYC business tax if they earn income over a specified threshold. This includes entities such as corporations and partnerships that engage in rent-generating activities. By leveraging the NY DoF CR-Q2 information, business owners can stay informed about their tax responsibilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.