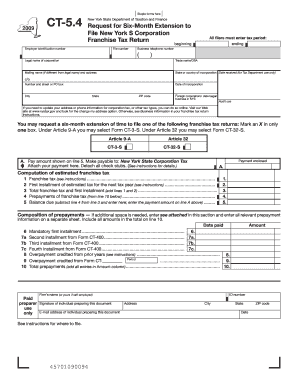

Get Ny Ct-5.4 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY CT-5.4 online

How to fill out and sign NY CT-5.4 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, the majority of Americans choose to file their own taxes and indeed prefer to finalize documents in digital format. The US Legal Forms online platform simplifies the process of e-filing the NY CT-5.4, making it user-friendly. Presently, it requires no more than 30 minutes, and you can complete it from virtually anywhere.

Ways to obtain NY CT-5.4 swiftly and effortlessly:

Ensure that you have accurately completed and submitted the NY CT-5.4 on time. Keep an eye on any due dates. Providing incorrect information in your financial statements may lead to significant penalties and complications with your yearly tax return. Only utilize official templates from US Legal Forms!

- Review the PDF template in the editor.

- Locate the designated fillable fields where you can input your details.

- Select the option to determine if you can view the checkboxes.

- Explore the Text icon along with other advanced functions to customize the NY CT-5.4 manually.

- Double-check all information prior to proceeding with your signature.

- Craft your personalized eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your online template electronically and specify the exact date.

- Click Done to proceed.

- Download or send the document to the intended recipient.

How to modify Get NY CT-5.4 2009: personalize forms online

Choose a reliable document editing service that you can trust. Amend, finalize, and endorse Get NY CT-5.4 2009 securely online.

Often, handling forms, such as Get NY CT-5.4 2009, can be challenging, particularly if you received them digitally but lack specific software. Certainly, you can utilize some alternatives to bypass this issue, but you risk obtaining a form that fails to meet submission criteria. Using a printer and scanner isn’t advisable either due to the time and resources required.

We provide a simpler and more efficient method for altering forms. A comprehensive library of document templates that are straightforward to modify and validate, making them fillable for others. Our platform offers much more than just a set of templates. One of the greatest advantages of using our service is that you can alter Get NY CT-5.4 2009 directly on our website.

Being an online solution, it spares you the need to install any software on your computer. Moreover, not all corporate policies allow software installations on company laptops. Here’s the simplest way to effectively and securely finalize your documents with our service.

Bid farewell to paper and other outdated methods of executing your Get NY CT-5.4 2009 or other documents. Utilize our tool instead, which merges one of the most extensive libraries of editable templates with a powerful document editing feature. It's straightforward and secure, and it can save you a significant amount of time! Don’t merely take our word for it, give it a try yourself!

- Click on Get Form > and you will be redirected instantly to our editor.

- Once opened, you can begin the customization process.

- Select checkmark, circle, line, arrow, cross, and other options to mark your document.

- Choose the date option to insert a specific date into your template.

- Incorporate text boxes, images, notes, and more to enhance the content.

- Leverage the fillable fields feature on the right to designate fillable {fields.

- Select Sign from the upper toolbar to create and generate your legally binding signature.

- Click DONE and save, print, share, or obtain the output.

Get form

Your NYS extension form should be mailed to the address indicated in the form's instructions. This ensures that your request for an extension is properly received and acknowledged. Take care to follow any specific instructions that may be provided. If you need additional information on this process, consider checking out US Legal Forms for reliable guidance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.