Loading

Get Ny Ct-5.4 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CT-5.4 online

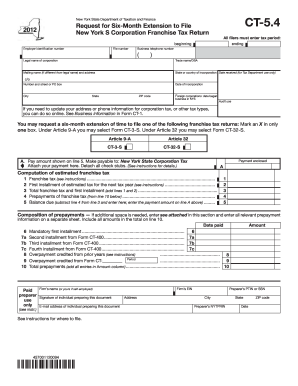

The NY CT-5.4 form is essential for corporations seeking a six-month extension to file their franchise tax return. This guide will provide a step-by-step approach to filling out the form online, ensuring clarity and ease of use for all individuals involved in the process.

Follow the steps to complete the form successfully

- Press the ‘Get Form’ button to access the CT-5.4 form and open it in the online editor.

- Enter the tax period, which includes both the beginning and ending dates of the fiscal year you're reporting for.

- Provide your employer identification number, file number, and business telephone number.

- Fill in the legal name of the corporation, along with the trade name or DBA if applicable.

- Specify the mailing name and address, including street address or PO box, city, state, and ZIP code. If the corporation is foreign, include the date you began doing business in New York State.

- Indicate the article under which you are filing by marking an X in the appropriate box for Article 9-A or Article 32.

- Complete the payment section by entering the amount shown on line 5 and attaching your payment if applicable. Make sure to follow the instructions for the payment.

- Fill in the computation of estimated franchise tax, including entries for lines 1 to 5. Make sure to calculate your total franchise tax and first installment.

- List all prepayments in the composition section. If you need more space, clearly indicate it and provide the relevant information on a separate sheet.

- Finalize the form by including the preparer's information, including their name, address, email, and signature. Make sure all necessary details are accurately filled out.

- Once all sections are completed, save your changes, and you can download, print, or share the form as needed.

Complete your documents online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To calculate your state AGI, begin with your federal adjusted gross income and make adjustments based on your state's tax laws. In New York, these adjustments will follow the guidelines stated in specific tax forms, including NY CT-5.4. Ensuring accuracy in this calculation will help provide a clearer picture of your tax obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.