Loading

Get Ny Ct-2658-e 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CT-2658-E online

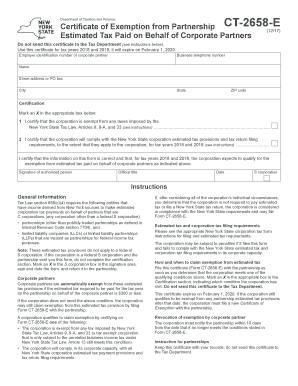

The NY CT-2658-E form is a Certificate of Exemption from Partnership that allows corporations to certify their exemption from certain estimated tax payments. This guide provides a step-by-step approach to accurately complete the form online, ensuring you fulfill your requirements properly while saving time and effort.

Follow the steps to fill out the NY CT-2658-E form online.

- Press the ‘Get Form’ button to access the NY CT-2658-E form and view it in the editor.

- Enter the employer identification number of the corporate partner in the designated field.

- Provide the business telephone number of the corporation by filling out the appropriate field.

- Fill in the name of the corporation as it appears on official documents.

- Enter the street address or PO box of the corporation.

- Complete the city field by providing the city where the corporation is located.

- Specify the state in which the corporation operates.

- Fill in the ZIP code corresponding to the corporation's address.

- In the Certification section, mark an X in the box that applies: 1 for exemption from taxes or 2 for compliance with tax provisions.

- Certify that the information provided is correct by confirming your understanding of the corporate tax obligations.

- Sign the form where indicated to validate the submission, providing your official title.

- Include the date on which the form is signed.

- Finally, save your changes, download, print, or share the form as necessary.

Complete your NY CT-2658-E form online today to ensure compliance and take advantage of your exemption!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Nonresidents who have income sourced from North Dakota must file a North Dakota nonresident tax return. This is necessary for individuals who earn income through employment, business, or property located in the state. Familiarizing yourself with the requirements ensures proper compliance with North Dakota tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.