Get Nm Trd Trd-31109 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

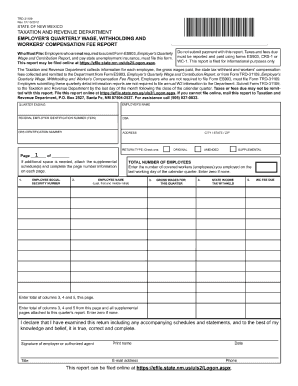

Tips on how to fill out, edit and sign NM TRD TRD-31109 online

How to fill out and sign NM TRD TRD-31109 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans are inclined to complete their own income taxes and additionally, to fill out documents digitally.

The US Legal Forms online platform assists in streamlining the process of e-filing the NM TRD TRD-31109 in a straightforward and convenient manner.

Ensure that you have accurately filled out and submitted the NM TRD TRD-31109 by the deadline. Review any relevant terms. Providing incorrect information in your financial documents can result in significant penalties and complications with your yearly tax return. Utilize only professional templates with US Legal Forms!

- Access the PDF template within the editor.

- Look at the designated fillable fields. This is where your information should be entered.

- Choose the option when you encounter the checkboxes.

- Explore the Text icon alongside other robust features to manually tailor the NM TRD TRD-31109.

- Double-check all details prior to proceeding to sign.

- Create your personalized eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

- Authorize your web document electronically and add the date.

- Select Done to proceed.

- Save or forward the document to the recipient.

How to Modify Get NM TRD TRD-31109 2012: Personalize Forms Online

Streamline your document preparation process and tailor it to your specifications in just a few clicks. Complete and authorize Get NM TRD TRD-31109 2012 using a powerful yet user-friendly online editor.

Handling documentation can be a hassle, particularly when you encounter it sporadically. It requires you to meticulously observe all the regulations and accurately complete all fields with truthful and precise information. Nonetheless, it frequently occurs that you need to modify the form or incorporate additional fields to complete. If you want to enhance Get NM TRD TRD-31109 2012 before sending it, the most straightforward approach is by utilizing our robust yet easy-to-use online editing tools.

This all-encompassing PDF editing solution enables you to effortlessly and promptly complete legal documents from any device with internet access, make quick adjustments to the form, and add extra fillable fields. The service permits you to choose a specific area for each type of information, such as Name, Signature, Currency, and SSN, etc. You can designate them as mandatory or conditional and decide who should fill in each field by assigning them to a particular recipient.

Follow the steps below to enhance your Get NM TRD TRD-31109 2012 online:

Our editor is a versatile, multi-functional online solution that can assist you in effortlessly optimizing Get NM TRD TRD-31109 2012 along with various other templates tailored to your needs. Minimize document preparation and submission time and create professional-looking forms without difficulty.

- Access the required document from the catalog.

- Complete the gaps with Text and apply Check and Cross tools to the tickboxes.

- Use the right-side toolbar to modify the form by adding new fillable sections.

- Select the fields according to the type of data you want to be collected.

- Make these fields mandatory, optional, or conditional and arrange their order.

- Assign each field to a specific party using the Add Signer tool.

- Ensure all necessary changes have been made and click Done.

Get form

The payroll tax rate in Mexico can vary based on various factors, including federal and state tax regulations. Generally, employees can expect a combination of income tax and contributions to social security, with rates differing across regions. While this question may not directly relate to NM TRD TRD-31109, understanding local tax laws is crucial if you're working with employees from Mexico or managing cross-border payroll.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.